Government Initiatives and Funding

Government support plays a crucial role in the development of the plasma fractionation market. In South Korea, various initiatives aimed at enhancing healthcare infrastructure and promoting research in biopharmaceuticals are underway. The government has allocated substantial funding to support research and development in this sector, which is expected to foster innovation in plasma fractionation technologies. For instance, recent budgets have earmarked millions of dollars for advancing bioprocessing capabilities. Such financial backing not only encourages local companies to invest in plasma fractionation but also attracts foreign investments, thereby expanding the market landscape.

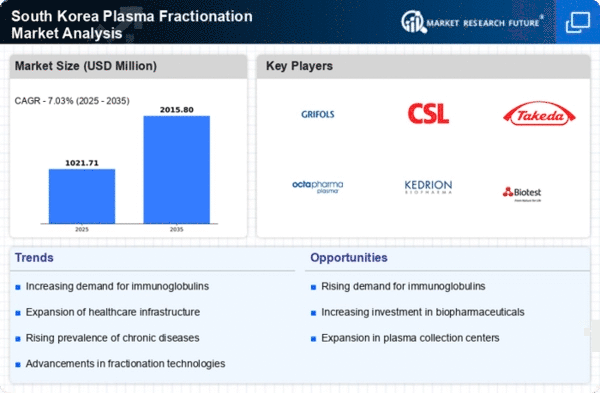

Rising Investment in Biopharmaceuticals

The surge in investment within the biopharmaceutical sector is a key driver for the plasma fractionation market. South Korea has emerged as a hub for biopharmaceutical research, attracting both domestic and international investors. The increasing focus on developing novel therapies and biologics has led to a rise in funding for plasma fractionation projects. Reports indicate that investments in biopharmaceuticals have grown by over 15% annually, reflecting a strong commitment to advancing this field. This influx of capital is expected to facilitate the expansion of plasma fractionation capabilities, ultimately benefiting the market.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South Korea is a pivotal driver for the plasma fractionation market. Conditions such as hemophilia, immune deficiencies, and other blood-related disorders necessitate the use of plasma-derived therapies. As the population ages, the demand for these therapies is expected to grow, potentially increasing the market size significantly. Reports indicate that the prevalence of hemophilia alone is around 1 in 10,000 individuals, which translates to a substantial patient base requiring treatment. This trend suggests that healthcare providers will increasingly rely on plasma fractionation to meet therapeutic needs, thereby propelling the market forward.

Growing Awareness of Plasma-Derived Products

There is a noticeable increase in public awareness regarding the benefits of plasma-derived products in South Korea. Educational campaigns and outreach programs have been instrumental in informing both healthcare professionals and patients about the efficacy of these therapies. This heightened awareness is likely to drive demand for plasma fractionation products, as patients become more informed about their treatment options. Market data suggests that the demand for immunoglobulins, a key product of plasma fractionation, has seen an annual growth rate of approximately 8% in recent years. This trend indicates a robust market potential as awareness continues to rise.

Technological Innovations in Plasma Processing

Technological advancements in plasma processing are significantly influencing the plasma fractionation market. Innovations such as improved separation techniques and enhanced purification processes are leading to higher yields and better quality of plasma-derived products. In South Korea, companies are increasingly adopting automated systems and advanced bioreactors, which streamline production and reduce costs. These innovations not only improve efficiency but also ensure compliance with stringent regulatory standards. As a result, the market is likely to experience growth driven by the introduction of new technologies that enhance product offerings and operational capabilities.