Focus on Enhanced Patient Safety

In South Korea, there is a heightened focus on patient safety and quality of care, which is significantly influencing the surgical navigation-systems market. Healthcare institutions are increasingly prioritizing technologies that minimize risks associated with surgical procedures. Surgical navigation systems are recognized for their ability to enhance precision, thereby reducing the likelihood of complications and improving overall patient outcomes. Recent studies indicate that the implementation of these systems can lead to a decrease in post-operative complications by as much as 25%. As patient safety becomes a central tenet of healthcare policy, the demand for advanced surgical navigation systems is expected to grow, reflecting a commitment to high-quality surgical care.

Aging Population and Increased Surgical Needs

The demographic shift towards an aging population in South Korea is creating a substantial impact on the surgical navigation-systems market. As the elderly population grows, there is a corresponding increase in the prevalence of chronic diseases that often require surgical intervention. This demographic trend is expected to drive the demand for advanced surgical navigation systems, which facilitate complex procedures with higher accuracy. Projections suggest that by 2030, the population aged 65 and older will account for over 20% of the total population, leading to an increased need for surgical solutions. Consequently, the surgical navigation-systems market is poised for growth as healthcare providers adapt to meet the rising surgical demands of this demographic.

Rising Demand for Minimally Invasive Procedures

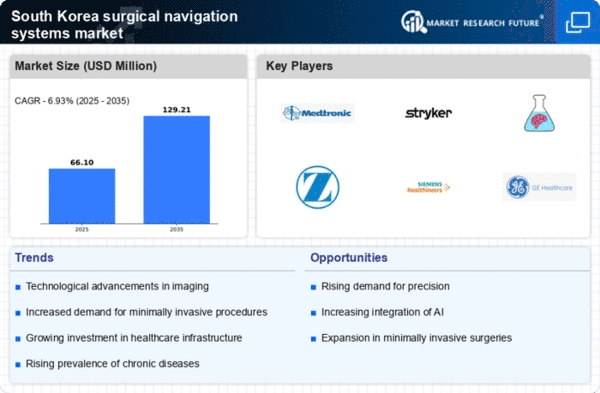

The surgical navigation-systems market in South Korea is experiencing a notable increase in demand for minimally invasive surgical procedures. This trend is driven by the growing preference among patients for surgeries that promise reduced recovery times and lower risk of complications. As a result, healthcare providers are increasingly adopting advanced surgical navigation systems to enhance precision and accuracy during these procedures. According to recent data, the market for minimally invasive surgeries is projected to grow at a CAGR of approximately 10% over the next five years. This shift not only improves patient outcomes but also aligns with the broader goals of healthcare efficiency and cost reduction, thereby propelling the surgical navigation-systems market forward.

Technological Integration in Healthcare Facilities

The integration of advanced technologies within healthcare facilities in South Korea is significantly influencing the surgical navigation-systems market. Hospitals and surgical centers are increasingly investing in state-of-the-art navigation systems that incorporate augmented reality (AR) and artificial intelligence (AI) to enhance surgical precision. This technological evolution is expected to improve surgical outcomes and reduce the duration of procedures. Recent statistics indicate that the adoption of such technologies could lead to a reduction in surgical errors by up to 30%. As healthcare facilities strive to remain competitive and improve patient care, the demand for sophisticated surgical navigation systems is likely to rise, further driving market growth.

Government Initiatives to Promote Healthcare Innovation

The South Korean government is actively promoting healthcare innovation, which is positively impacting the surgical navigation-systems market. Various initiatives aimed at enhancing healthcare technology adoption are being implemented, including funding for research and development in surgical technologies. These government-backed programs are designed to encourage collaboration between public and private sectors, fostering an environment conducive to innovation. As a result, the surgical navigation-systems market is likely to benefit from increased investment and support for new technologies. Reports suggest that government funding in healthcare technology could increase by 15% over the next few years, further stimulating growth in the surgical navigation-systems market.