Rising Cancer Incidence

The increasing incidence of cancer in Spain is a primary driver for the circulating tumor-cell market. According to recent statistics, cancer cases are projected to rise by approximately 20% over the next decade. This surge in cancer diagnoses necessitates advanced diagnostic tools, including those that utilize circulating tumor cells. As healthcare providers seek to improve patient outcomes, the demand for innovative solutions in cancer detection and monitoring is likely to grow. The circulating tumor-cell market is positioned to benefit from this trend, as it offers technologies that can enhance early detection and treatment personalization. Furthermore, the Spanish healthcare system is increasingly prioritizing cancer care, which may lead to greater investments in research and development of circulating tumor-cell technologies.

Increased Research Funding

The circulating tumor-cell market is experiencing growth due to increased funding for cancer research in Spain. Government and private sector investments are being directed towards innovative cancer therapies and diagnostic solutions. In recent years, funding for cancer research has seen a rise of approximately 30%, which is expected to continue. This influx of capital is facilitating the development of new technologies related to circulating tumor cells, thereby enhancing their application in clinical practice. The circulating tumor-cell market stands to gain from this trend, as researchers and companies collaborate to bring novel solutions to market. Enhanced funding not only accelerates research but also fosters partnerships between academic institutions and industry players, further driving innovation in the field.

Growing Awareness of Early Detection

There is a growing awareness among the Spanish population regarding the importance of early cancer detection, which is positively impacting the circulating tumor-cell market. Public health campaigns and educational initiatives are emphasizing the benefits of early diagnosis, leading to increased screening and testing. As patients become more informed, the demand for advanced diagnostic tools, including those that utilize circulating tumor cells, is likely to rise. This shift in patient behavior is prompting healthcare providers to adopt more sophisticated technologies to meet the needs of their patients. Consequently, the circulating tumor-cell market is expected to expand as it aligns with the increasing emphasis on early detection and preventive healthcare measures.

Advancements in Diagnostic Technologies

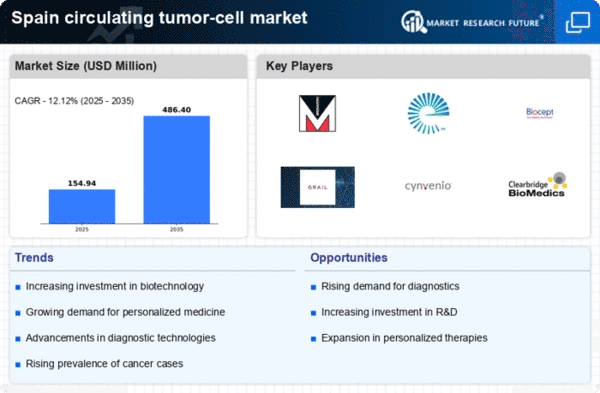

Technological innovations in diagnostic methods are significantly influencing the circulating tumor-cell market. In Spain, the integration of advanced imaging techniques and molecular diagnostics is enhancing the ability to detect circulating tumor cells with higher sensitivity and specificity. For instance, liquid biopsy technologies are gaining traction, allowing for non-invasive cancer detection and monitoring. The market for liquid biopsy is expected to grow at a CAGR of around 15% in the coming years. This growth is indicative of the increasing reliance on circulating tumor-cell technologies in clinical settings. As healthcare professionals adopt these advanced diagnostic tools, the circulating tumor-cell market is likely to expand, driven by the need for accurate and timely cancer diagnostics.

Regulatory Support for Innovative Therapies

Regulatory bodies in Spain are increasingly supportive of innovative cancer therapies, which is beneficial for the circulating tumor-cell market. Recent initiatives aimed at expediting the approval process for novel diagnostic tools and treatments are encouraging the development of circulating tumor-cell technologies. The Spanish Medicines Agency has implemented frameworks that facilitate faster access to cutting-edge therapies, thereby promoting innovation in the healthcare sector. This regulatory environment is likely to stimulate investment in the circulating tumor-cell market, as companies seek to bring their products to market more efficiently. As a result, the landscape for circulating tumor-cell technologies is expected to evolve, with a focus on meeting regulatory standards while addressing the urgent needs of cancer patients.