Growth in Automotive Electronics

The automotive sector in Spain is experiencing a significant transformation, with a marked increase in the integration of electronics in vehicles. This trend is likely to drive the serdes market, as modern vehicles require advanced communication systems for features such as autonomous driving and infotainment. The automotive electronics market is projected to grow at a CAGR of 8% through 2027, indicating a robust demand for serdes solutions that facilitate high-speed data transfer between various vehicle components. As the automotive industry continues to innovate, the serdes market is poised to play a crucial role in enabling these advancements, ensuring reliable and efficient communication within vehicles.

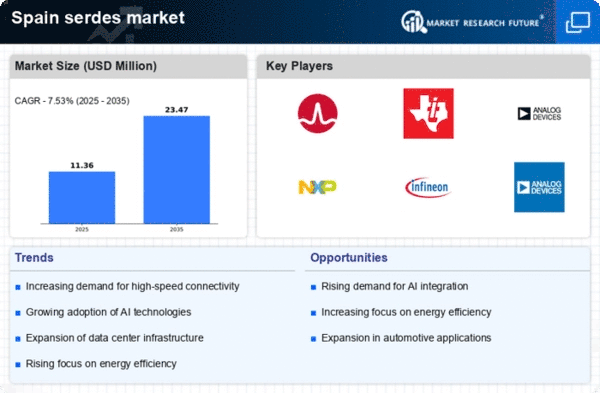

Surge in Data Center Investments

Spain is witnessing a surge in data center investments, driven by the increasing reliance on cloud computing and big data analytics. This trend is expected to significantly impact the serdes market, as data centers require high-performance interconnect solutions to manage vast amounts of data efficiently. The investment in data centers is projected to exceed €3 billion by 2025, creating a substantial demand for advanced serdes technologies. The serdes market is likely to capitalize on this growth, providing essential solutions that enhance data throughput and reduce latency, thereby supporting the evolving needs of data-driven enterprises.

Regulatory Support for Digital Transformation

The Spanish government is actively promoting digital transformation across various industries, which is likely to bolster the serdes market. Initiatives aimed at enhancing digital infrastructure and encouraging innovation are expected to create a favorable environment for the adoption of advanced technologies. With funding programs and incentives in place, businesses are more inclined to invest in high-performance communication solutions, including serdes technologies. The serdes market stands to benefit from this regulatory support, as companies seek to modernize their operations and improve connectivity, potentially leading to a market expansion of approximately 5% annually over the next few years.

Expansion of Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure in Spain appears to be a primary driver for the serdes market. With the increasing demand for high-speed internet and mobile connectivity, telecommunications companies are investing heavily in upgrading their networks. This investment is projected to reach approximately €10 billion by 2026, focusing on fiber optics and 5G technology. As a result, the need for efficient serialization and deserialization solutions is likely to grow, enhancing the performance of data transmission. The serdes market is expected to benefit from this trend, as companies seek to implement advanced serdes solutions to support the burgeoning data traffic and improve overall network efficiency.

Emergence of Artificial Intelligence Applications

The rise of artificial intelligence (AI) applications in various sectors, including finance, healthcare, and manufacturing, is likely to influence the serdes market in Spain. AI systems require high-speed data processing capabilities, which can be facilitated by advanced serdes solutions. As organizations increasingly adopt AI technologies, the demand for efficient data communication is expected to grow. The serdes market may see a corresponding increase in the adoption of specialized serdes products designed to support AI workloads, potentially leading to a market growth rate of around 6% annually through 2028. This trend underscores the importance of serdes technologies in enabling the seamless operation of AI applications.