Top Industry Leaders in the Specialty Metallic Pigments Market

Specialty metallic pigments (SMPs) add a touch of magic to our everyday lives, adorning everything from cars and cosmetics to plastics and printing inks. These shimmering wonders, unlike their more common oxide counterparts, possess unique optical properties that create dazzling effects like luster, iridescence, and metallic sheen. The SMP market, though niche, pulsates with fierce competition and constant innovation. Understanding its intricacies requires a deep dive into the key players, their strategies, and the factors driving market share.

Specialty metallic pigments (SMPs) add a touch of magic to our everyday lives, adorning everything from cars and cosmetics to plastics and printing inks. These shimmering wonders, unlike their more common oxide counterparts, possess unique optical properties that create dazzling effects like luster, iridescence, and metallic sheen. The SMP market, though niche, pulsates with fierce competition and constant innovation. Understanding its intricacies requires a deep dive into the key players, their strategies, and the factors driving market share.

Market Leaders and their Shimmering Strategies:

-

Merck KGaA: This German giant reigns supreme with its extensive portfolio of effect pigments under the Iriodin and Xirallic brands. They leverage their R&D prowess and global reach to cater to diverse industries. -

BASF SE: Another chemical giant, BASF, shines with its Paliocrom and Lumina brands, focusing on high-performance pigments for demanding applications like automotive coatings and luxury goods. -

Dow Chemical: Dow brings its global manufacturing muscle and technical expertise to the table with its SpectraPearl and MelioStar lines, targeting a wide range of consumer and industrial applications. -

Sun Chemical: This leading ink manufacturer paints the market with its SunFlair and SolarColor brands, specializing in pigments for printing inks and plastics. -

Kolmar Group: Rounding up the top five is Kolmar, a rising star known for its innovative EcoGlitter line of bio-based and biodegradable pigments, resonating with the growing emphasis on sustainability.

Factors Dictating Market Share:

Beyond brand recognition, several key factors influence market share in the SMP market:

-

Innovation: Developing novel pigments with improved brightness, color spectrum, or special effects like thermochromism (color change with temperature) fuels differentiation and market penetration. Recent examples include BASF's Lumina Royal Amethyst for a vibrant purple hue and Dow's SpectraPearl GeoLite for a unique shimmering texture. -

Sustainability: The rising demand for eco-friendly solutions is pushing the boundaries of SMP development. Kolmar's EcoGlitter line and BASF's efforts in bio-based pigment precursors exemplify this trend. -

Regulatory Landscape: Stringent regulations on heavy metals and volatile organic compounds (VOCs) used in some pigments necessitate the development of compliant alternatives. Merck's focus on solvent-free and low-VOC pigments caters to this growing concern. -

Application-Specific Solutions: Understanding and catering to the specific needs of different industries, like high-temperature resistance for automotive coatings or chemical stability for cosmetics, is crucial for market success. Sun Chemical's expertise in tailor-made pigments for various printing applications underscores this point.

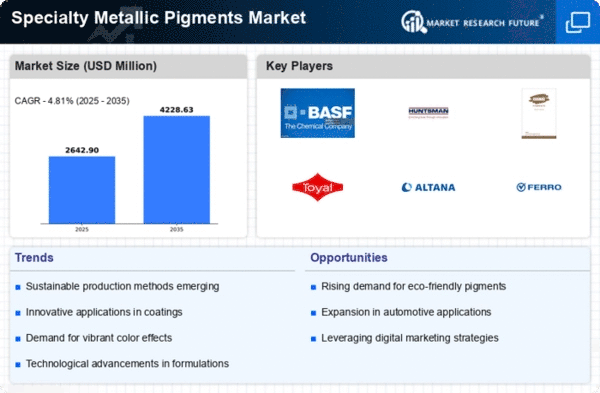

Key Players

Some of the prominent players operating in the Global Specialty Metallic Pigments Market are BASF SE (Germany), Sigma Technologies Int'l, LLC (U.S.), Silberline Manufacturing Co., Inc. (U.S.), Kolortek Co., Ltd (China), Carl Schlenk AG (Germany), AMETEK.Inc. (U.S.), Sun Chemical Corporation. (U.S.), Asahi Kasei Corporation (Japan), Toyal America, Inc. (U.S.), COPRABEL S.A. (Belgium), and others.

Recent Developments:

-

September 2023: Regional expansion continues with Merck's new distribution center in India and Sun Chemical's strategic partnership with a distributor in Latin America. -

October 2023: Innovation flourishes with BASF's development of a pigment that changes color under UV light and Dow's launch of a highly heat-resistant SMP for engine coatings. -

November 2023: Regulatory concerns emerge with stricter environmental regulations in Europe impacting raw material sourcing for some players. -

December 2023: Industry collaboration takes center stage with the formation of a consortium to develop standardized testing methods for SMPs.