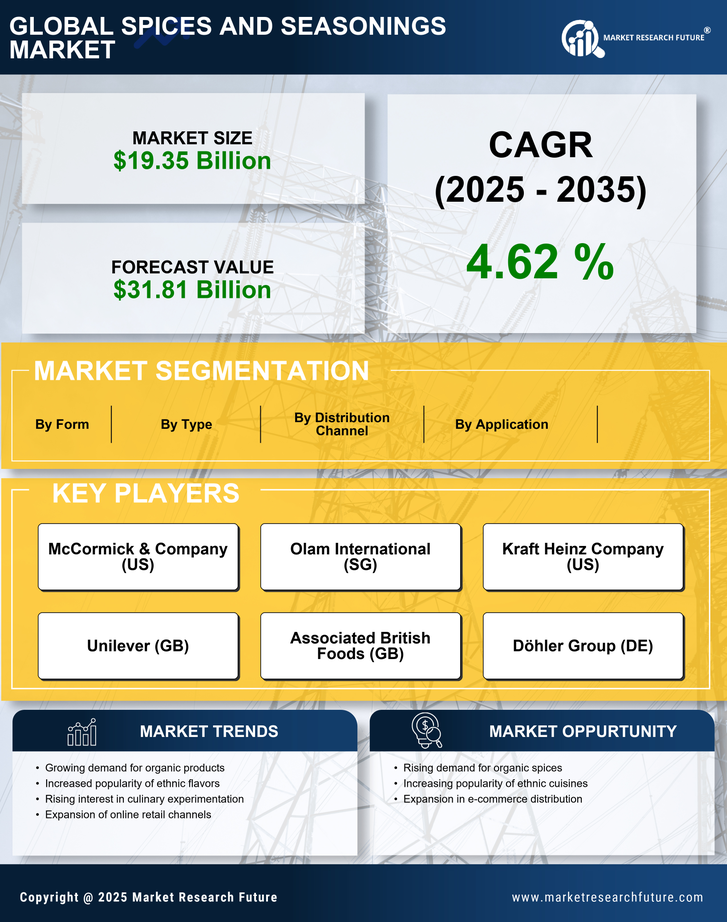

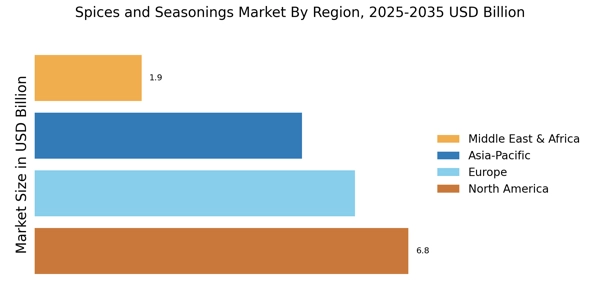

North America : Market Leader in Spices

North America is the largest market for spices and seasonings, holding approximately 35% of the global market share. The region's growth is driven by increasing consumer interest in culinary diversity, health-conscious eating, and the rise of gourmet cooking. Regulatory support for food safety and quality standards further catalyzes market expansion, ensuring that products meet high safety and quality benchmarks. The United States is the leading country in this region, with major players like McCormick & Company and Kraft Heinz Company dominating the landscape. The competitive environment is characterized by innovation in product offerings, including organic and specialty spices. Canada also plays a significant role, contributing to the market with a growing demand for ethnic flavors and health-oriented products.

Europe : Culinary Innovation Hub

Europe is a significant player in the spices and seasonings market, accounting for approximately 30% of the global share. The region's growth is fueled by a rising trend in home cooking, increased demand for organic products, and a focus on sustainability. Regulatory frameworks, such as the EU's food safety regulations, ensure high standards for spice quality and safety, further driving consumer confidence and market growth. Leading countries include Germany, France, and the UK, where companies like Unilever and Associated British Foods are key players. The competitive landscape is marked by a blend of traditional and innovative products, catering to diverse culinary preferences. The presence of local and international brands fosters a dynamic market environment, enhancing consumer choice and driving sales.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is an emerging powerhouse in the spices and seasonings market, holding around 25% of the global market share. The region's growth is driven by increasing urbanization, rising disposable incomes, and a growing interest in diverse cuisines. Regulatory initiatives aimed at improving food safety standards are also contributing to market expansion, ensuring that products meet consumer expectations for quality and safety. Countries like India and China are at the forefront, with India being a major producer and exporter of spices. The competitive landscape features both local and international players, including Olam International and Döhler Group. The region's rich culinary heritage and demand for authentic flavors create a vibrant market, attracting investments and fostering innovation in product development.

Middle East and Africa : Diverse Culinary Landscape

The Middle East and Africa region is witnessing a growing interest in spices and seasonings, accounting for approximately 10% of the global market share. The growth is driven by increasing consumer awareness of health benefits associated with spices, along with a rise in culinary tourism. Regulatory frameworks are evolving to enhance food safety and quality, which is crucial for market development in this diverse region. Leading countries include South Africa and the UAE, where the market is characterized by a mix of traditional and modern culinary practices. Key players like Spice World and Badia Spices are making significant inroads, catering to both local tastes and international demands. The competitive landscape is dynamic, with a focus on innovation and product diversification to meet the needs of a diverse consumer base.