Global Sports Sponsorship Market Overview

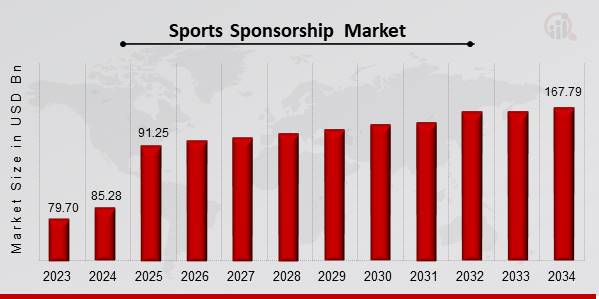

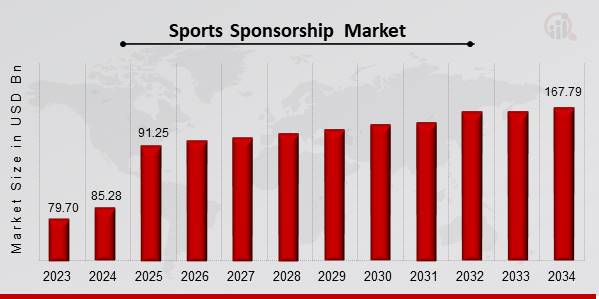

Sports Sponsorship Market Size was valued at USD 85.28 Billion in 2024. The Sports Sponsorship industry is projected to grow from USD 91.25 Billion in 2024 to USD 167.79 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7% during the forecast period (2025 - 2034). With the growing number of sports events and the fact that sponsorships have a larger reach in comparison to traditional marketing such as advertising & sales promotions are expected to be a significant market driver for the Sports Sponsorship Market.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Sports Sponsorship Market Trends

- Large number of sporting events organized across the world and growing viewership of sports events is driving the market growth

Market CAGR for Sports Sponsorship is being driven by the Large Number of Sporting Events Organized across the World and Growing Viewership of Sport Events. A diverse array of sports is played ly, each governed by associations and bodies that organize large-scale events worldwide, drawing the participation of athletes and teams. Numerous sporting events are held annually or at fixed intervals, such as the UEFA Champions League, Super Bowl, tennis Grand Slam tournaments, Formula One racing, and the NBA.

Additionally, major events like the FIFA World Cup, Olympic Games, ICC Cricket World Cup, and Rugby Union World Cup occur at regular intervals of four years. These events, characterized by high viewership, attract extensive sponsorships from various companies. Furthermore, the continual organization of both established and new sporting events worldwide contributes significantly to the growth of the sports sponsorship market.

Sports represent one of the oldest and most popular forms of entertainment, consistently garnering higher viewership than movies and TV shows. Notably, association football boasts an average daily viewership of 3.5 billion, cricket reaches 2.5 billion, and field hockey engages 2 billion viewers. The trend is further accentuated by the increasing attendance at various sporting events. For instance, the 272 regular-season NFL games in 2021 achieved an average viewership of 17.1 billion across television and digital platforms, marking a 10% increase from 2020 and the highest average since 2015.

Similarly, the 2021/22 UEFA Champions League final between Real Madrid and Liverpool recorded an average of 2.76 billion viewers in the USA, demonstrating a 23% growth compared to the previous year's final between Chelsea and Manchester City. The expanding viewership provides sponsors with an extended reach, propelling the sports sponsorship market.

As a result, it is anticipated that throughout the projection period, demand for the Sports Sponsorship Market will increase due to the Large Number of Sporting Events Organized across the World and the Growing Viewership of Sports Events. Thus, driving the Sports Sponsorship industry revenue.

Sports Sponsorship Market Segment Insights

Sports Sponsorship Market Type Insights

The Sports Sponsorship Market segmentation, based on Type includes Signage, Digital Activation, Club and Venue Activation, and Others. The Signage segment dominated the market, accounting for 58% of market revenue). Signage configurations often vary based on sponsorship levels, with major sporting events or venues offering different tiers of sponsorship that come with varying degrees of signage visibility. Premium signage locations, such as the centerfield billboard at a baseball stadium or courtside LED boards in a basketball arena, are typically reserved for higher-tier sponsors. This tiered approach encourages sponsors to make higher financial commitments, leading to increased brand visibility.

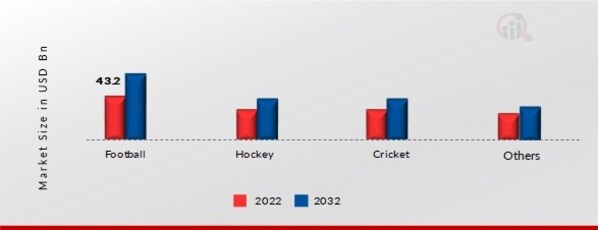

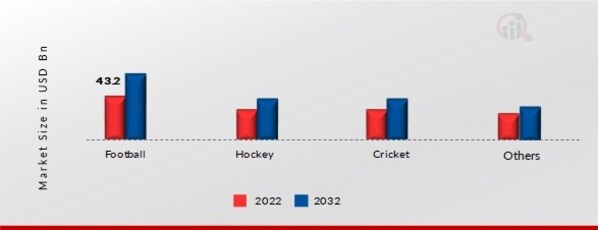

Sports Sponsorship Market Sports Insights

The Sports Sponsorship Market segmentation, based on Sports includes Football, Hockey, Cricket, and Others. The Football segment dominated the market, accounting for 58% of market revenue. The expansion and increased visibility of women's football provide sponsors with additional avenues for investment. Brands are forging partnerships to support the growth and promotion of women's football, recognizing its potential to reach a broad and engaged audience. In this emerging realm of football sponsorship, sponsors have unique opportunities to connect with dedicated fans and contribute to the advancement of women's sports.

Figure 1: Sports Sponsorship Market, by Sports, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Sports Sponsorship Market Application Insights

The Sports Sponsorship Market segmentation, based on Application includes Competition Sponsorship, Training Sponsorship, and Others. The Training Sponsorship segment dominated the market, accounting for 60% of market revenue. Training sponsorships are increasingly recognizing the importance of tailored training plans designed to meet the specific needs of individual athletes or teams. Sponsors provide customized training schedules, access to qualified trainers, or branded sports equipment to assist athletes in realizing their full potential.

Sports Sponsorship Market Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. The anticipated expansion of the Sports Sponsorship market in North America can be attributed to several key factors. The growth of the North American market is propelled by factors such as the rise of new sporting events and increased spending on sports sponsorship. Major sponsors in the region are drawn to sports like football, baseball, basketball, motorsports, and rugby.

The United States holds significant importance in the North American sports sponsorship market, featuring prominent leagues such as the National Basketball Association (NBA), National Football League (NFL), National Hockey League (NHL), Major League Baseball (MLB), and the US and North American Soccer Leagues. Additionally, the incorporation of technology and analytics into sports sponsorships is identified as a key trend. This integration allows sponsors to closely monitor their return on investment (ROI) during sponsored sports events.

Leading sponsors, such as PepsiCo Inc. (PepsiCo), have already initiated comprehensive partnerships incorporating analytics, as seen in their collaboration with SoFi Stadium, granting PepsiCo category-exclusive marketing, promotional rights, and sponsorship for the stadium's development.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: SPORTS SPONSORSHIP MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Sports Sponsorship Market accounts for the second-largest market share as the European region commands a significant market share due to its well-established sports environment and high athlete participation rates. Countries like the United Kingdom stand out for the diversity of sports interests, with approximately 40.7% of male adults and around 31.7% of female adults participating in sports weekly. The emergence of various sporting leagues and increased fan engagement has transformed the sports sector into a powerhouse, offering unexplored avenues and numerous opportunities. Football continues to dominate the European market, holding the largest market share.

Europe, as the second-largest region contributing to market revenue, benefits from the popularity of university and college-level sports teams and leagues, such as MLB (Major Basketball League), NFL (National Football League), and NBA (National Basketball Association), which are poised to drive the sports sponsorships market in the projected period. Further, the German Sports Sponsorship Market held the largest market share, and the UK Sports Sponsorship Market was the fastest-growing market in the European region.

The Asia-Pacific Sports Sponsorship Market is expected to grow at the fastest CAGR from 2023 to 2032. The sports sponsorship market in the Asia-Pacific region is expected to witness accelerated growth, driven by the active involvement of Japan, India, and China. Key factors propelling market expansion include a well-established sports industry, increasing participation in sports activities, and a rising demand for sports merchandise among tourists. The Sports Authority of India has played a significant role by establishing 23 National Centres of Excellence and 67 SAI Training Centres to implement sports promotional schemes nationwide.

Additionally, the allocation of $1.1 billion in capital expenditure under the National Investment Pipeline for sports infrastructure development (FY20-FY25) is expected to further contribute to market growth. The Asia-Pacific region is experiencing a surge in sports and exercise activities, particularly among the younger population. For instance, according to the Australian Institute of Health and Welfare, millions of Australians participate in sports and physical recreation activities annually, driven by various motivations such as competition, commuting, and enjoyment. Moreover, China’s Sports Sponsorship Market held the largest market share, and the Indian Sports Sponsorship Market was the fastest-growing market in the Asia-Pacific region.

Sports Sponsorship Market Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Sports Sponsorship market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Sports Sponsorship industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Sports Sponsorship industry to benefit clients and increase the market sector. In recent years, the Sports Sponsorship industry has offered some of the most significant advantages to the sports and entertainment sector. Major players in the Sports Sponsorship Market, including Castrol India Limited, Red Bull GmbH, Adidas AG, Puma SE, Anheuser-Busch InBev SA/NV, PepsiCo, Inc., ASICS Corporation, Nike, Inc., Electronic Arts Inc., Macron S.p.A is attempting to increase market demand by investing in research and development operations.

Electronic Arts Inc (EA) is a prominent gaming software provider engaged in the development, marketing, publishing, and distribution of digital interactive video games for various gaming consoles and systems. These include Microsoft Xbox, Apple App Store, Google Play Store, Sony PlayStation, and Nintendo WiiU. EA also creates gaming software for mobile devices, tablets, PCs, and the internet. The company's diverse portfolio of games encompasses popular titles like Need for Speed, Battlefield, The Sims, Apex Legends, Plants v. Zombies, and more. Additionally, EA markets games under licensed brands such as FIFA, Madden NFL, and Star Wars.

The company delivers its games and services through digital distribution channels and retail outlets, operating ly, including in Europe, Asia, and North America. Electronic Arts Inc. is headquartered in Redwood City, California, USA. In August 2022, EA forged a partnership with LaLiga, a prominent entity in football entertainment, becoming the title sponsor for all LaLiga competitions

Adidas AG specializes in the design, manufacturing, and marketing of athletic and sports lifestyle products. The company's diverse product portfolio includes footwear, apparel, and accessories such as bags, sunglasses, fitness equipment, and balls. adidas distributes and sells its products through various channels, including own-branded stores, retail outlets, wholesale stores, sporting goods chains, department stores, lifestyle retail chains, e-retailers, and franchise stores. Additionally, the company utilizes e-commerce platforms and mobile shopping apps to market its products. adidas focuses on its flagship Adidas brand and engages in various product franchises.

Operating ly, Adidas has a presence in the Americas, Europe, Asia-Pacific, Africa, and the Middle East, with its headquarters located in Herzogenaurach, Germany. In August 2020, Adidas entered the arena of kit sponsorship and Official Merchandising Partner Rights for the Indian Cricket Team after a prolonged hiatus. This move is set to expire soon, coinciding with the conclusion of Nike's agreement with India's BCCI, Adidas' rival in the sports goods industry.

Key companies in the Sports Sponsorship Market include

- Anheuser-Busch InBev SA/NV

Sports Sponsorship Industry Developments

June 2023: In June 2023, Anheuser-Busch InBev SA/NV prolonged its association with FIFA, the international association for football competitions, maintaining its role as the official beer sponsor for the FIFA Women’s World Cup 2023 and FIFA World Cup 2026

June 2020: In June 2022, Macron S.P.A. renewed its technical sponsorship agreement with the Albanian Football Federation. This extended partnership entails Macron supplying technical sportswear to all youth teams affiliated with the federation's football academies.

Sports Sponsorship Market Segmentation

Sports Sponsorship Market Type Outlook

- Club and Venue Activation

Sports Sponsorship Market Sports Outlook

Sports Sponsorship Market Application Outlook

Sports Sponsorship Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 85.28 Billion |

| Market Size 2025 |

USD 91.25 Billion |

| Market Size 2034 |

USD 167.79 Billion |

| Compound Annual Growth Rate (CAGR) |

7% (2025-2034) |

| Base Year |

2024 |

| Market Forecast Period |

2025-2034 |

| Historical Data |

2019- 2023 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Sports, Application, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Castrol India Limited, Red Bull GmbH, Adidas AG, Puma SE, Anheuser-Busch InBev SA/NV, PepsiCo, Inc., ASICS Corporation, Nike, Inc., Electronic Arts Inc., Macron S.p.A. |

| Key Market Opportunities |

· The favorable policies of various governments encouraging sports among millennials |

| Key Market Dynamics |

· The growing number of new sporting events across the globe |

Frequently Asked Questions (FAQ):

The Sports Sponsorship Market size was valued at USD 79.70 Billion in 2023.

The Sports Sponsorship Market is projected to grow at a CAGR of 7% during the forecast period, 2025-2034.

North America had the largest share of the market.

The key players in the market are Castrol India Limited, Red Bull GmbH, Adidas AG, Puma SE, Anheuser-Busch InBev SA/NV, PepsiCo, Inc., ASICS Corporation, Nike, Inc., Electronic Arts Inc., Macron S.p.A

The Signage segment dominated the market in 2022.

The Training Sponsorship segment had the largest share in the market.