Expansion of the Staffing Industry

The Staffing Factoring Service Market is closely linked to the expansion of the staffing industry itself. As companies continue to hire temporary and contract workers, the demand for staffing services is projected to grow. In 2025, the staffing industry is expected to generate revenues exceeding 150 billion USD, which in turn fuels the need for factoring services. Staffing agencies often face challenges in managing cash flow due to delayed payments from clients. Factoring services provide a solution by allowing these agencies to receive immediate payment for their invoices. This symbiotic relationship between the staffing industry and factoring services suggests that as the staffing sector expands, so too will the demand for staffing factoring services.

Rising Need for Cash Flow Solutions

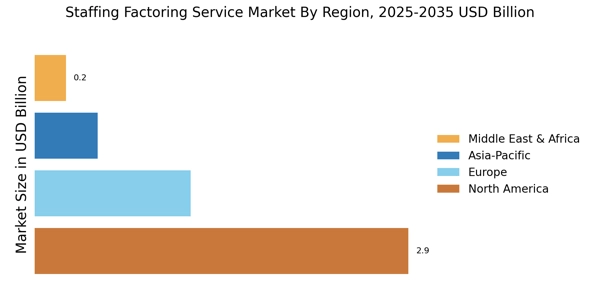

The Staffing Factoring Service Market is experiencing a notable increase in demand for cash flow solutions among staffing agencies. As businesses seek to maintain liquidity, the reliance on factoring services has surged. In 2025, it is estimated that the market for staffing factoring services will reach approximately 3 billion USD, driven by the need for immediate cash to cover operational costs. This trend indicates that staffing agencies are increasingly turning to factoring as a viable option to manage their financial obligations. The ability to convert invoices into cash quickly allows these agencies to invest in growth opportunities and meet payroll demands without delay. Consequently, the rising need for cash flow solutions is a significant driver in the Staffing Factoring Service Market.

Growing Awareness of Financial Solutions

The Staffing Factoring Service Market is benefiting from a growing awareness of financial solutions available to staffing agencies. As more agencies recognize the advantages of factoring, the market is likely to expand. Educational initiatives and marketing efforts by factoring companies are contributing to this awareness, highlighting the benefits of improved cash flow and reduced financial stress. In 2025, it is anticipated that the number of staffing agencies utilizing factoring services will increase by 30%, reflecting this heightened awareness. This trend indicates that as staffing agencies become more informed about their financial options, the demand for staffing factoring services will continue to rise, driving growth in the industry.

Increased Focus on Operational Efficiency

In the Staffing Factoring Service Market, there is a growing emphasis on operational efficiency among staffing agencies. Companies are increasingly seeking ways to streamline their processes and reduce overhead costs. Factoring services offer a means to enhance cash flow management, allowing staffing agencies to focus on their core operations rather than financial constraints. By utilizing factoring, agencies can minimize the time spent on collections and improve their overall efficiency. This trend is particularly relevant in a competitive market where operational excellence can differentiate successful agencies from their peers. As a result, the increased focus on operational efficiency is a key driver in the Staffing Factoring Service Market.

Technological Advancements in Factoring Services

The Staffing Factoring Service Market is witnessing a transformation due to technological advancements. Innovations in financial technology are enabling staffing agencies to access factoring services more efficiently. Online platforms and automated processes are streamlining the application and funding procedures, making it easier for agencies to obtain financing. In 2025, it is projected that the adoption of technology in factoring services will increase by 25%, enhancing the overall user experience. This shift not only reduces the time required for funding but also improves transparency and reduces costs associated with traditional factoring methods. Consequently, technological advancements are a significant driver in the Staffing Factoring Service Market.