Top Industry Leaders in the Static Random Access Memory Market

Competitive Landscape of Static Random Access Memory (SRAM) Market:

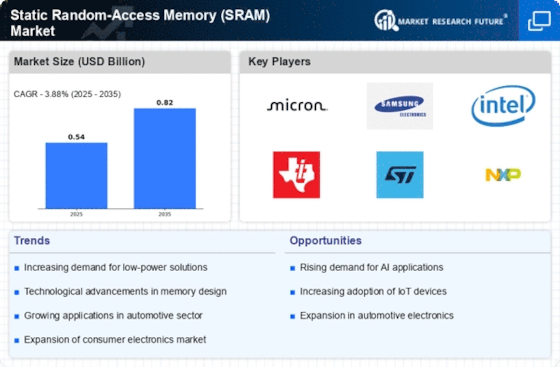

The Static Random Access Memory (SRAM) market, despite facing slight contraction in recent years, remains a crucial component of the global semiconductor landscape. Its high-speed data access and volatility-immune nature make it irreplaceable in various applications like microcontrollers, networking equipment, and high-performance computing. Understanding the competitive landscape of this dynamic market is vital for stakeholders to navigate its complexities.

Key Players:

- GCL System Integration

- Hanwha Q CELLS Co. Ltd.

- Sharp Corporation

Strategies Adopted by Key Players:

The market is characterized by a mix of established players and emerging players, each with distinct strategies. Leading companies like Samsung, Cypress Semiconductor, Renesas, and ON Semiconductor have diversified portfolios catering to various market segments. Their focus lies on continuous technology advancements, optimizing power consumption and density, and securing long-term supply chain partnerships.

Emerging players like Winbond Electronics, GigaDevice, and Alpha and Omega Semiconductor are carving niches by offering cost-competitive solutions and targeting specific applications like automotive and industrial IoT. They leverage fabless models and strategic alliances to gain market traction.

Market Share Analysis

Analyzing market share in the SRAM market requires a nuanced approach, considering various factors beyond sheer revenue figures. Key parameters include:

- Product Portfolio Mix: Companies offering a wider range of SRAM densities and types (e.g., embedded SRAM, low-power SRAM) tend to have a larger share.

- Geographical Presence: Strong regional footprints, especially in Asia, where major electronics manufacturing hubs are concentrated, contribute to market share dominance.

- Technological Leadership: Companies at the forefront of SRAM innovation, like high-density or low-power technologies, attract premium pricing and secure lucrative contracts.

- Vertical Market Penetration: Deep understanding and customized solutions for specific applications like automotive or medical devices can translate to significant market share within that segment.

New and Emerging Companies:

Start-ups and smaller players are entering the SRAM market with innovative approaches:

- Specialized SRAM Solutions: Companies like SiFive are focusing on niche applications like RISC-V processors, offering customized SRAM designs for optimal performance and efficiency.

- Next-generation Technologies: Start-ups like Everspin are developing magnetoresistive RAM (MRAM) technologies that challenge SRAM's dominance in specific areas like industrial automation due to their non-volatility and endurance.

- Fabless Model Optimization: By leveraging foundry partnerships and focusing on design expertise, fabless companies like QuickLogic are reducing capital expenditure and offering cost-competitive SRAM solutions.

Industry Developments

SRAM Industry Developments:

- October 2022: Cypress Semiconductor Corp. announced a joint venture with SK Hynix System Inc. to develop and manufacture next-generation SRAM technologies.

- 2023 (ongoing): Increased demand for high-performance SRAM in applications like artificial intelligence (AI) and edge computing is driving market growth.

- Emerging trends: Focus on low-power SRAM designs, 3D integration technologies, and radiation-hardened SRAM for space applications.

- GCL System Integration and Hanwha Q CELLS:

- GCL System Integration:

Recent news focuses on module launches and partnerships in the solar energy sector. No significant updates related to SRAM were found.

The company faced financial difficulties in recent years due to Chinese government policy changes in the solar industry.

- Hanwha Q CELLS:

Similar to GCL, recent news highlights Hanwha's involvement in solar cell production, module development, and sustainability initiatives. No mention of SRAM development was found.