Research Methodology on Static Random Access Memory Market

Introduction

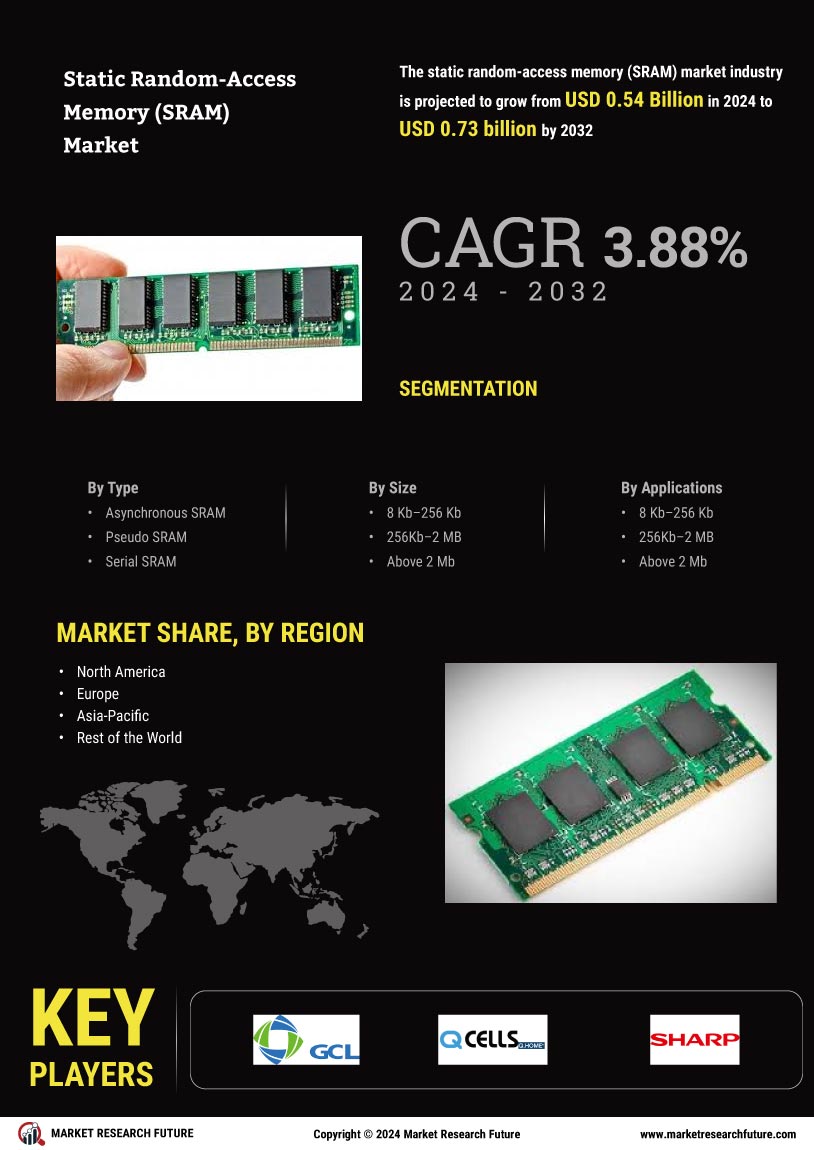

This research aims to examine the global static random access memory (SRAM) market. SRAM is a type of semiconductor memory which utilizes four transistors to store each bit of data. SRAM has several benefits such as faster read and write capabilities, low power requirements Static Random Access Memory Market, high density and low latency which makes it suitable to be used across a variety of consumer goods.

SRAMs come in various densities and voltages depending on the particular application. Thus, this market has a lot of opportunities as various consumer electronics goods such as smartphones, computers and digital cameras are using it as a memory chip. This research intends to identify the various drivers and restraints influencing the SRAM market and assess their impact on the overall market growth.

Research Methodology

This research intends to utilize both primary and secondary methods of data collection to effectively evaluate the global SRAM market. The primary methods include qualitative and quantitative data collection, leveraging methods such as semi-structured interviews, surveys, focus group interviews and opinion polls. The primary data is collected from various industry experts, market participants, key opinion leaders and decision-makers. The qualitative data collected from primary sources will be used to analyze various trends and patterns prevailing in the market.

The secondary data will be derived from various annual reports and publications, company websites, newspapers and business magazines, governmental organizations, industry research reports and surveys. The secondary data will be used to study the overall global SRAM market size, trends and dynamics. Once the data is collected, it will be further analyzed using advanced quantitative and qualitative data analysis methods such as market attractiveness analysis, segmentation analysis and Porter's five forces. The analysis will help to identify the various drivers and restraints impacting the global SRAM market growth.

Research Objectives

- To analyze the global SRAM market size.

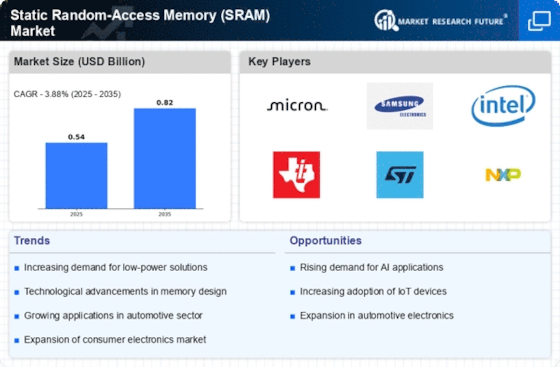

- To analyze the impact of various technological and economic developments on the global SRAM market.

- To analyze the various upcoming opportunities in the global SRAM market.

- To identify the various drivers and restraints influencing the global SRAM market growth.

- To conduct a competitive analysis of the global SRAM market.

- To conduct Porter's five forces analysis to assess the competitive intensity in the global SRAM market.

Timeframe and Geography

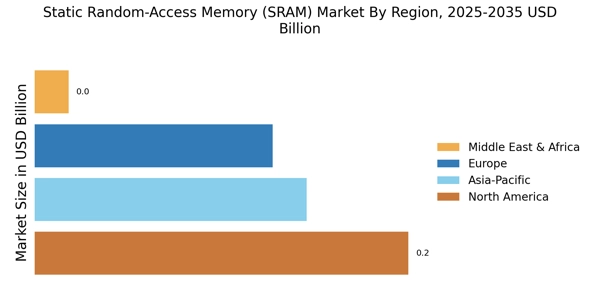

The study is intended to be conducted over a period of 4 months and focus on the global market. The geographical scope of the study will include every major region such as Europe, Asia Pacific, North America, Latin America, and Middle East and Africa.

Data Collection and Analysis

The data collected from various primary and secondary sources discussed above will be analyzed using various advanced data analysis tools and techniques. The various tools and techniques that will be used to analyze the collected data are market attractiveness analysis, segmentation analysis and Porter's five forces.

Market attractiveness analysis will be used to identify the various lucrative opportunities prevailing in the global market. The attractiveness of the global SRAM market will be analyzed based on various factors such as market size, growth potential, and market revenue.

Segmentation analysis will be utilized to divide the global SRAM market into different segments based on product type, application, industry and geography. Through segmentation analysis, the market will be further divided to comprehend the overall dynamics of the global SRAM market.

Porter's five forces model will be used to analyze the competitive dynamics in the market. The analysis will help to identify the various market forces such as suppliers, buyers, competitors and substitutes. Through the analysis, the research team will be able to understand the bargaining power of the buyers and suppliers.

Conclusion

Through this research, the research team aims to analyze the global SRAM market in-depth and identify the various drivers and restraints inhibiting the market growth. The project will be conducted using both primary and secondary methods of data collection and the collected data will be further analyzed using advanced quantitative and qualitative research techniques such as market attractiveness analysis, segmentation analysis and Porter's five forces. The research is expected to provide key insights into the dynamics of the SRAM market, identify potential opportunities and provide decision-makers with valuable ideas and recommendations along with forecasts from 2023 to 2030.