Regulatory Framework and Incentives

Government policies and regulatory frameworks are crucial drivers of the Stationary Storage And Standby Power Market. Many governments are implementing incentives and subsidies to promote the adoption of energy storage technologies. These initiatives aim to reduce greenhouse gas emissions and enhance energy security. For instance, tax credits and grants for energy storage installations are becoming more common, encouraging businesses and homeowners to invest in stationary storage solutions. The regulatory landscape is evolving, with many regions setting ambitious targets for renewable energy integration, which in turn boosts the demand for energy storage systems. As a result, the market is expected to experience robust growth, with projections indicating a potential increase in market size by over 25% in the next five years.

Growing Awareness of Energy Efficiency

There is a rising awareness of energy efficiency and sustainability among consumers and businesses, which is significantly impacting the Stationary Storage And Standby Power Market. As energy costs continue to rise, organizations are increasingly seeking solutions that not only provide backup power but also enhance overall energy efficiency. This trend is leading to a greater emphasis on energy management systems that incorporate stationary storage solutions. The market is likely to benefit from this shift, as consumers become more educated about the advantages of energy storage in reducing energy bills and carbon footprints. Recent surveys indicate that nearly 70% of businesses are considering energy storage as part of their energy strategy, suggesting a strong potential for growth in the stationary storage market.

Increased Adoption of Renewable Energy

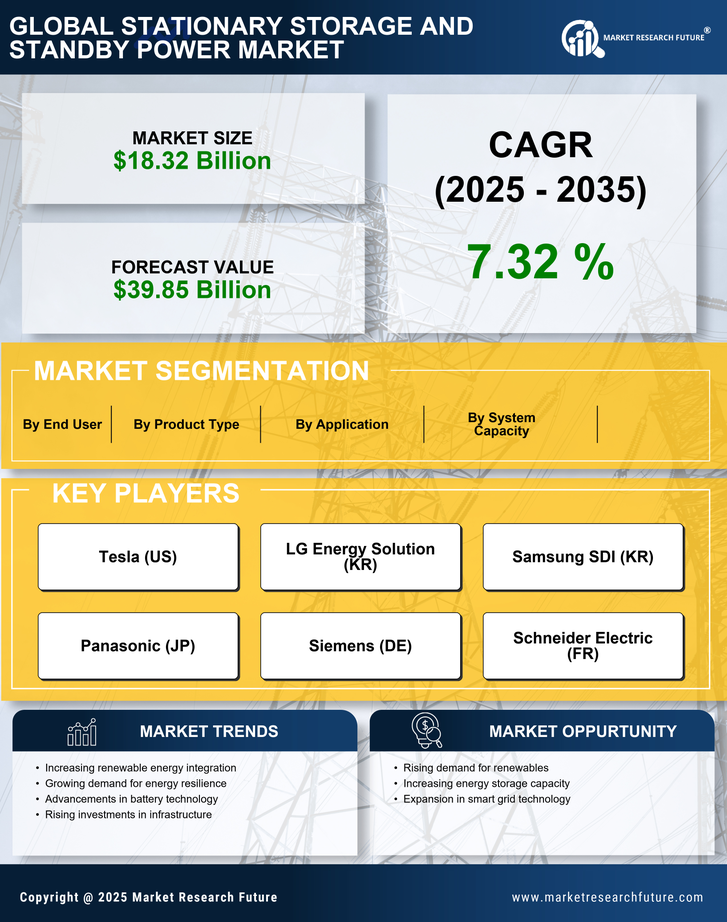

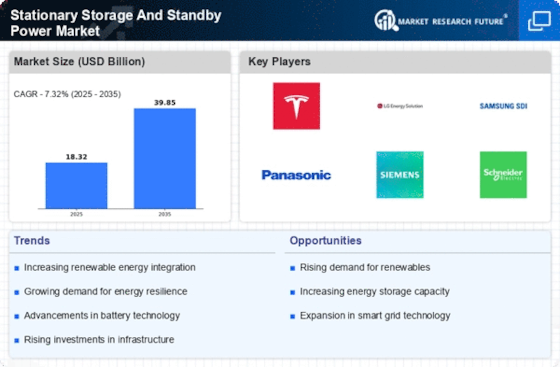

The transition towards renewable energy sources is reshaping the energy landscape, thereby influencing the Stationary Storage And Standby Power Market. As countries strive to meet their sustainability goals, the integration of solar and wind energy has become more prevalent. This shift necessitates efficient energy storage solutions to manage the intermittent nature of renewable sources. The market for stationary storage systems is expected to expand as businesses and households invest in solar panels and wind turbines, which require reliable backup power. Recent data indicates that the global capacity for energy storage is projected to grow by over 30% annually, highlighting the critical role of stationary storage in supporting renewable energy initiatives and ensuring energy security.

Technological Innovations in Energy Storage

Technological advancements are playing a pivotal role in shaping the Stationary Storage And Standby Power Market. Innovations in battery technology, such as lithium-ion and solid-state batteries, are enhancing the efficiency and capacity of energy storage systems. These advancements not only improve the performance of stationary storage solutions but also reduce costs, making them more accessible to a broader range of consumers. The market is witnessing a surge in research and development activities aimed at creating more efficient and sustainable energy storage technologies. As a result, the energy storage market is anticipated to grow at a compound annual growth rate of over 20% in the coming years, driven by the increasing demand for high-performance energy solutions.

Rising Demand for Uninterrupted Power Supply

The increasing reliance on technology across various sectors has led to a heightened demand for uninterrupted power supply solutions. In the Stationary Storage And Standby Power Market, this trend is particularly evident in critical sectors such as healthcare, data centers, and telecommunications. As businesses seek to mitigate the risks associated with power outages, the market for stationary storage and standby power systems is projected to grow significantly. According to recent estimates, the market is expected to reach a valuation of approximately USD 20 billion by 2026, driven by the need for reliable power solutions. This demand is further fueled by the growing number of electric vehicles and the electrification of transportation, which necessitate robust energy storage systems to ensure seamless operation.