Energy Sector Growth

The energy sector, particularly oil and gas, is a significant driver for the Steel Pipes And Tubes Market. The demand for seamless and welded steel pipes is increasing due to the need for efficient transportation of oil and gas. As energy consumption rises, the industry anticipates a surge in exploration and production activities, which will require extensive pipeline networks. Reports indicate that the oil and gas industry is expected to invest over 1 trillion dollars in infrastructure by 2027, further propelling the demand for steel pipes and tubes. This growth in the energy sector is likely to have a cascading effect on the Steel Pipes And Tubes Market, enhancing its overall market dynamics.

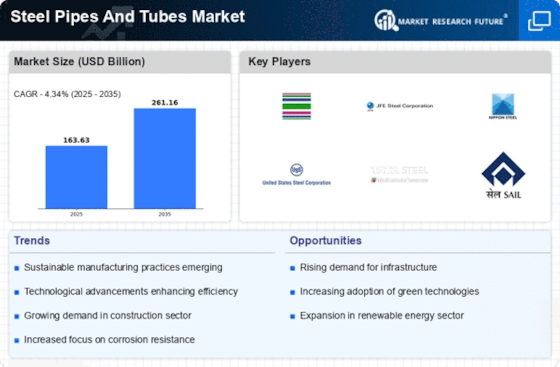

Technological Innovations

Technological innovations in manufacturing processes are significantly influencing the Steel Pipes And Tubes Market. Advancements such as automated production lines and improved welding techniques are enhancing the quality and efficiency of steel pipe production. These innovations not only reduce production costs but also enable the creation of specialized products tailored to specific applications. The market is witnessing a shift towards high-strength and corrosion-resistant steel pipes, which are essential for demanding environments. As manufacturers adopt these technologies, the Steel Pipes And Tubes Market is expected to expand, driven by the need for superior products that meet evolving industry standards.

Automotive Industry Demand

The automotive industry is increasingly relying on steel pipes and tubes for various applications, serving as a vital driver for the Steel Pipes And Tubes Market. As vehicle manufacturers seek to enhance fuel efficiency and reduce emissions, the use of lightweight steel components is becoming more prevalent. The automotive sector is projected to grow at a compound annual growth rate of 3.5%, which will likely lead to increased demand for steel pipes and tubes in exhaust systems, fuel lines, and structural components. This trend suggests that the Steel Pipes And Tubes Market will benefit from the automotive sector's evolution towards more sustainable and efficient designs.

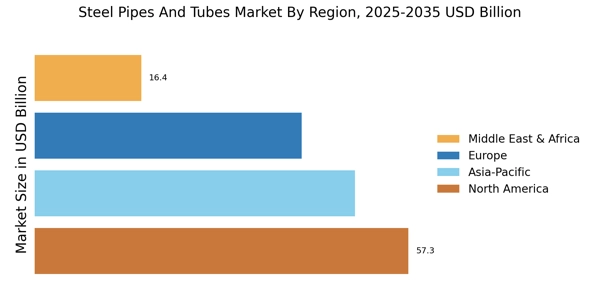

Infrastructure Development

The ongoing expansion of infrastructure projects worldwide is a primary driver for the Steel Pipes And Tubes Market. Governments and private sectors are investing heavily in the construction of roads, bridges, and buildings, which necessitates the use of steel pipes and tubes for structural integrity and fluid transport. For instance, the construction sector is projected to grow at a rate of 4.5% annually, leading to increased demand for steel products. This trend is further supported by urbanization, as more people migrate to cities, necessitating the development of housing and public utilities. Consequently, the Steel Pipes And Tubes Market is likely to experience robust growth as these infrastructure projects progress.

Water and Wastewater Management

The growing emphasis on water and wastewater management is emerging as a crucial driver for the Steel Pipes And Tubes Market. With increasing concerns over water scarcity and pollution, investments in water infrastructure are on the rise. Steel pipes are essential for the construction of water supply systems and wastewater treatment facilities. According to recent estimates, The Steel Pipes And Tubes is projected to reach 1 trillion dollars by 2026, which will significantly boost the demand for steel pipes and tubes. This trend indicates a strong correlation between environmental sustainability efforts and the growth of the Steel Pipes And Tubes Market, as more regions prioritize efficient water management solutions.