Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the Supplier Relationship Management Software Market. These technologies enable organizations to analyze vast amounts of supplier data, leading to more informed decision-making and enhanced supplier performance. For instance, predictive analytics can identify potential risks in the supply chain, allowing companies to proactively address issues before they escalate. The market for AI-driven supplier relationship management solutions is projected to grow significantly, as businesses seek to leverage these innovations to gain a competitive edge. This technological evolution not only streamlines processes but also fosters stronger relationships with suppliers, ultimately contributing to improved business outcomes.

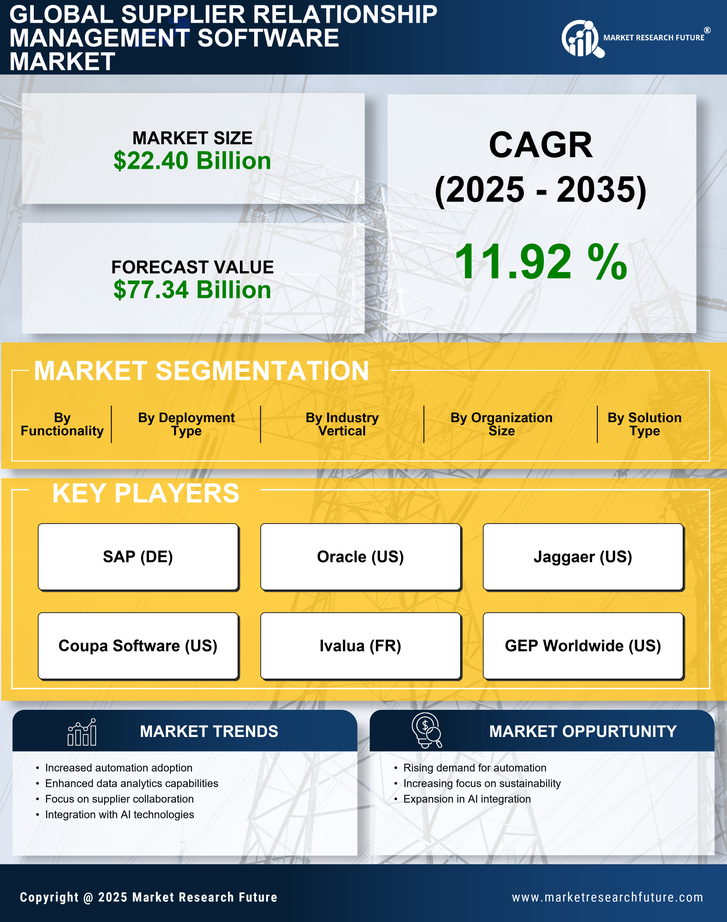

Rising Demand for Supply Chain Efficiency

The Supplier Relationship Management Software Market is experiencing a notable surge in demand as organizations strive for enhanced supply chain efficiency. Companies are increasingly recognizing the importance of optimizing supplier interactions to reduce costs and improve service delivery. According to recent data, organizations that implement effective supplier relationship management strategies can achieve up to a 20% reduction in procurement costs. This trend is driven by the need for businesses to remain competitive in a rapidly evolving market landscape, where agility and responsiveness are paramount. As a result, investments in supplier relationship management software are expected to rise, reflecting a broader commitment to operational excellence and strategic supplier partnerships.

Focus on Sustainability and Ethical Sourcing

The Supplier Relationship Management Software Market is increasingly shaped by the focus on sustainability and ethical sourcing practices. Organizations are under pressure from consumers and stakeholders to ensure that their suppliers adhere to sustainable practices and ethical labor standards. This has led to a growing demand for supplier relationship management solutions that can track and verify supplier compliance with sustainability criteria. Companies that prioritize sustainability in their supply chains are likely to enhance their brand reputation and customer loyalty. As a result, the market for supplier relationship management software that supports sustainability initiatives is expected to expand, reflecting a broader trend towards responsible sourcing and corporate social responsibility.

Increased Regulatory Compliance Requirements

The Supplier Relationship Management Software Market is also influenced by the growing emphasis on regulatory compliance across various sectors. Organizations are under increasing pressure to adhere to stringent regulations regarding supplier practices, sustainability, and ethical sourcing. This has led to a heightened focus on supplier relationship management solutions that facilitate compliance tracking and reporting. Companies that fail to meet these requirements risk facing significant penalties and reputational damage. As a result, the demand for software that can effectively manage supplier compliance is expected to rise, driving growth in the supplier relationship management software market. This trend underscores the critical role of technology in ensuring that organizations maintain compliance while fostering positive supplier relationships.

Shift Towards Collaborative Supplier Relationships

The Supplier Relationship Management Software Market is witnessing a paradigm shift towards more collaborative relationships between organizations and their suppliers. Companies are increasingly recognizing that fostering strong partnerships can lead to mutual benefits, such as innovation and cost savings. This shift is reflected in the growing adoption of collaborative supplier relationship management tools that facilitate communication and joint problem-solving. Research indicates that organizations that engage in collaborative supplier relationships can achieve up to a 30% improvement in product development cycles. As businesses seek to enhance their competitive positioning, the emphasis on collaboration is likely to drive further investment in supplier relationship management software, reinforcing the importance of strategic supplier partnerships.