Market Share

Supply Chain Analytics Market Share Analysis

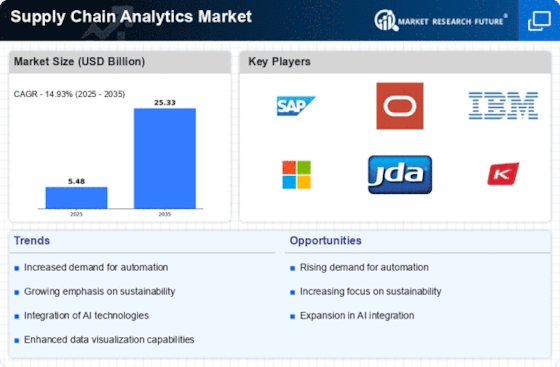

The Supply Chain Analytics Market is a dynamic and rapidly evolving sector that plays a crucial role in enhancing the efficiency and effectiveness of supply chain operations for businesses worldwide. Several market factors contribute to the growth and development of this market, shaping its landscape and influencing its trajectory.

One key factor driving the demand for supply chain analytics solutions is the increasing complexity of global supply chains. As businesses expand their operations globally, the need for real-time visibility, predictive analytics, and data-driven decision-making becomes paramount. Supply chain analytics provides companies with the tools to analyze vast amounts of data, identify patterns, and gain actionable insights, enabling them to optimize their supply chain processes and improve overall performance.

Another significant market factor is the rising awareness of the importance of data-driven decision-making. Companies are recognizing the value of leveraging data to make informed strategic and operational decisions. Supply chain analytics empowers organizations to harness the potential of big data, enabling them to make data-driven predictions, mitigate risks, and capitalize on opportunities. This growing awareness is driving the adoption of supply chain analytics solutions across various industries.

The advent of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is also contributing to the expansion of the supply chain analytics market. These technologies enable more sophisticated data analysis, allowing businesses to gain deeper insights into their supply chain processes. AI and ML algorithms can identify trends, anomalies, and correlations within large datasets, facilitating better decision-making and optimizing supply chain operations.

Furthermore, the increasing emphasis on cost reduction and operational efficiency is a critical market factor. Businesses are under constant pressure to streamline their supply chain processes, reduce costs, and improve overall efficiency. Supply chain analytics provides the necessary tools to identify inefficiencies, optimize inventory levels, and enhance demand forecasting, leading to cost savings and improved operational performance.

The demand for real-time analytics is another driving force in the supply chain analytics market. In today's fast-paced business environment, companies require instant access to relevant and accurate information to make timely decisions. Real-time analytics capabilities offered by supply chain analytics solutions enable organizations to monitor and respond to changes in the supply chain promptly, ensuring agility and responsiveness.

Moreover, the increasing focus on sustainability and environmental considerations is influencing the supply chain analytics market. Companies are recognizing the importance of incorporating sustainable practices into their supply chain processes. Analytics tools enable organizations to track and analyze the environmental impact of their supply chain activities, identify areas for improvement, and implement eco-friendly initiatives.

In conclusion, the Supply Chain Analytics Market is shaped by a combination of factors that reflect the evolving needs and challenges of today's business landscape. The increasing complexity of global supply chains, the growing awareness of data-driven decision-making, advancements in technology, the emphasis on cost reduction and efficiency, the demand for real-time analytics, and the focus on sustainability collectively drive the adoption of supply chain analytics solutions. As businesses continue to navigate a rapidly changing environment, the role of supply chain analytics in providing actionable insights and driving operational excellence is set to become even more critical in the years to come.

Leave a Comment