Market Trends

Key Emerging Trends in the Supply Chain Analytics Market

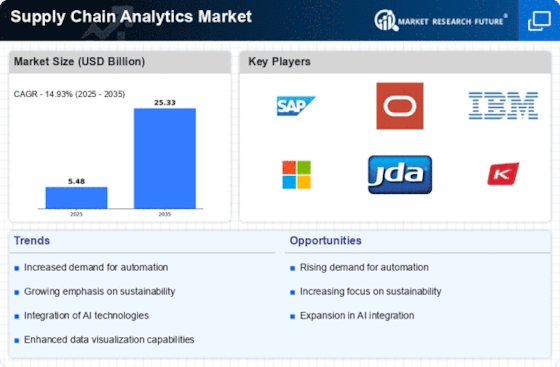

The Supply Chain Analytics market has experienced significant growth in recent years, driven by the increasing recognition of the strategic importance of efficient supply chain management. As businesses strive to enhance operational performance and gain a competitive edge, the adoption of supply chain analytics has become a key trend. One of the prominent market trends is the rising demand for real-time visibility and insights into supply chain operations. Companies are leveraging analytics solutions to track the entire supply chain in real-time, allowing them to identify bottlenecks, optimize inventory levels, and improve overall efficiency.

Moreover, there is a noticeable shift towards the integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), in supply chain analytics. These technologies enable predictive analytics, helping organizations forecast demand more accurately, optimize procurement processes, and mitigate risks. Predictive analytics also aids in demand planning, ensuring that companies can align their production and distribution strategies with actual market needs, thereby reducing excess inventory and minimizing supply chain disruptions.

Another significant market trend is the increasing focus on sustainability and environmental considerations within the supply chain. Businesses are incorporating analytics tools to measure and analyze the environmental impact of their supply chain activities. This not only aligns with the growing global emphasis on sustainable practices but also allows companies to optimize their processes for resource efficiency and reduce carbon footprints. Supply chain analytics helps in identifying opportunities for greener alternatives, optimizing transportation routes, and minimizing waste, contributing to a more sustainable and socially responsible supply chain.

Furthermore, the market is witnessing a surge in the adoption of cloud-based supply chain analytics solutions. Cloud technology offers scalability, flexibility, and cost-effectiveness, making it an attractive option for businesses of all sizes. Cloud-based analytics solutions enable real-time collaboration among stakeholders, regardless of their geographical locations, facilitating streamlined communication and decision-making. This trend is particularly beneficial for organizations seeking to modernize their supply chain processes without the burden of heavy infrastructure investments.

Cybersecurity concerns have also become a key focus in the supply chain analytics market. With the increasing digitization of supply chain processes and the growing volume of data being generated, the risk of cyber threats has intensified. As a result, companies are prioritizing the implementation of robust cybersecurity measures to safeguard sensitive supply chain information. This includes the adoption of encryption technologies, secure data storage solutions, and continuous monitoring to detect and respond to potential cyber threats promptly.

In conclusion, the market trends in supply chain analytics reflect a dynamic landscape where organizations are leveraging advanced technologies, embracing sustainability, adopting cloud-based solutions, and addressing cybersecurity challenges. The strategic integration of supply chain analytics is becoming indispensable for businesses looking to optimize their operations, enhance decision-making processes, and navigate the complexities of the modern supply chain. As the industry continues to evolve, companies that stay abreast of these trends are poised to gain a competitive advantage in the ever-changing global market.

Leave a Comment