Synthetic Bio Based Aniline Size

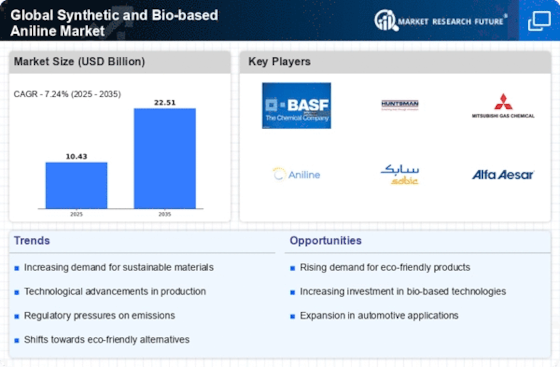

Synthetic Bio-Based Aniline Market Growth Projections and Opportunities

The market factors influencing the Synthetic and Bio-Based Aniline Market are multifaceted, playing a pivotal role in shaping the dynamics of this industry. One of the primary drivers propelling the market is the increasing demand for aniline in various end-use industries. Aniline, a key chemical compound, finds extensive applications in the production of polyurethane, rubber, dyes, and pharmaceuticals. As industrialization and urbanization continue to surge globally, the demand for these end-use products rises, consequently driving the demand for aniline.

On the synthetic front, the market is influenced by factors such as raw material availability and pricing. Petrochemical-based aniline production heavily relies on feedstocks derived from crude oil. Fluctuations in crude oil prices can significantly impact the overall production costs, directly affecting the pricing of synthetic aniline. Market players need to stay vigilant and adaptable to these price variations to maintain competitiveness in the market.

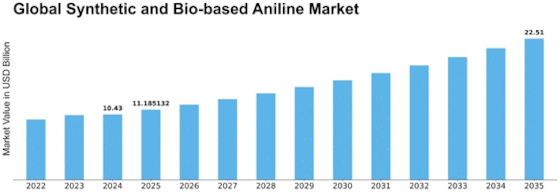

Synthetic and Bio-based Aniline Market Size was valued at USD 8.9 Billion in 2022. The synthetic and bio-based aniline market industry is projected to grow from USD 9.63 Billion in 2023 to USD 18.24 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.30%

Moreover, environmental concerns are shaping the landscape of the aniline market. The synthetic aniline production process often involves hazardous chemicals and by-products, contributing to environmental pollution. As sustainability becomes a global focus, there is a growing shift towards bio-based aniline derived from renewable feedstocks. The bio-based aniline market is gaining traction due to its eco-friendly nature, reduced carbon footprint, and the potential to meet stringent regulatory standards. Companies embracing bio-based alternatives are likely to attract environmentally conscious consumers and align themselves with evolving regulatory frameworks.

The regulatory landscape plays a crucial role in determining the market dynamics of both synthetic and bio-based aniline. Stringent regulations pertaining to environmental protection and worker safety drive companies to invest in research and development for cleaner and safer production processes. Compliance with regulations not only ensures ethical business practices but also enhances market reputation, enabling companies to access a wider consumer base.

Global economic conditions also contribute significantly to the market factors of synthetic and bio-based aniline. Economic downturns can impact industrial activities, leading to fluctuations in demand for aniline. Conversely, periods of economic growth, especially in emerging markets, can drive increased industrial production, subsequently boosting the demand for aniline.

In terms of competition, market dynamics are influenced by the presence of key players, their market share, and strategic initiatives. Mergers, acquisitions, partnerships, and collaborations among industry participants can reshape the competitive landscape, influencing market concentration and overall competitiveness. Companies that invest in innovation, product development, and strategic alliances are better positioned to adapt to evolving market trends and gain a competitive edge.

Consumer preferences and awareness also play a role in shaping the market factors of synthetic and bio-based aniline. With increasing awareness about environmental sustainability and the impact of chemical products on human health, consumers are showing a growing preference for eco-friendly and safer alternatives. This shift in consumer behavior can drive market players to prioritize the development and promotion of bio-based aniline products, meeting the rising demand for sustainable solutions.

Leave a Comment