Market Share

Synthetic Bio-Based Aniline Market Share Analysis

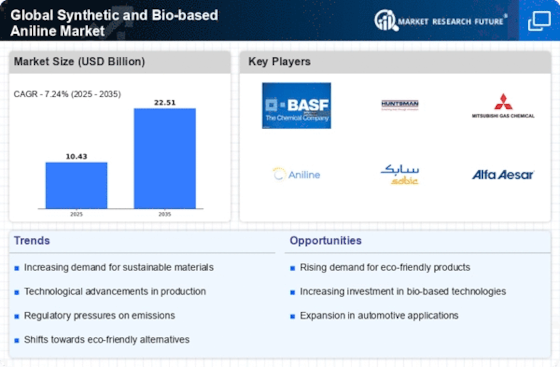

In the dynamic landscape of the chemical industry, the market share positioning strategies of the Synthetic and Bio-Based Aniline Market play a pivotal role in shaping the competitive scenario. Synthetic aniline, derived from petrochemical sources, and bio-based aniline, produced from renewable feedstocks, represent two distinct pathways within this sector. To gain a competitive edge, companies operating in this space deploy various strategic approaches aimed at enhancing their market share.

Synthetic aniline manufacturers often focus on economies of scale and cost leadership strategies. By optimizing production processes, improving efficiency, and leveraging bulk production advantages, they aim to reduce per-unit costs and offer competitive pricing to customers. This approach allows these companies to capture a larger market share by attracting cost-conscious customers and gaining a competitive edge in price-sensitive segments.

On the other hand, bio-based aniline producers differentiate themselves through sustainability and environmental consciousness. With an increasing emphasis on eco-friendly alternatives, companies in this segment position their products as greener and more sustainable options. By aligning with the growing demand for environmentally friendly solutions, bio-based aniline manufacturers can carve out a niche market share among consumers and businesses prioritizing sustainability in their operations.

In addition to cost and sustainability factors, innovation plays a crucial role in shaping market share positioning strategies. Both synthetic and bio-based aniline producers invest in research and development to create novel formulations, enhance product performance, and introduce unique features. The ability to offer differentiated products allows companies to attract customers seeking specialized solutions, thereby expanding their market share in specific application areas.

Market segmentation is another key strategy employed by aniline manufacturers. By identifying and targeting distinct market segments based on factors such as industry, application, or geography, companies can tailor their offerings to meet the specific needs of different customer groups. This targeted approach enables them to penetrate niche markets effectively and secure a substantial market share in specialized sectors.

Strategic partnerships and collaborations also contribute significantly to market share positioning in the Synthetic and Bio-Based Aniline Market. Companies often form alliances with raw material suppliers, distributors, or research institutions to strengthen their value chains, expand their market reach, and access new technologies. Such collaborations enhance their overall competitiveness and aid in securing a larger share of the market.

Furthermore, branding and marketing efforts play a crucial role in influencing customer perceptions and preferences. Effective branding strategies help companies establish a strong market presence, build trust among consumers, and differentiate their products from competitors. Whether emphasizing the reliability of synthetic aniline or the sustainability of bio-based alternatives, a well-crafted brand narrative contributes to market share growth by resonating with target audiences.

Leave a Comment