Emergence of 5G Technology

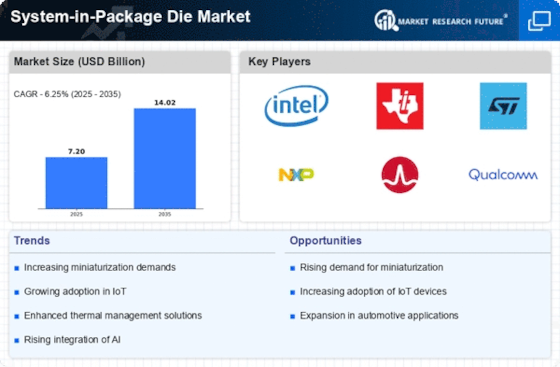

The System-in-Package Die Market is witnessing a transformative impact due to the emergence of 5G technology. The rollout of 5G networks necessitates advanced packaging solutions that can support higher frequencies and increased data rates. In 2025, the 5G infrastructure market is anticipated to surpass 300 billion USD, driving demand for System-in-Package solutions that can accommodate the complexities of 5G devices. These packaging technologies enable the integration of RF components, antennas, and processing units into a compact form factor, which is essential for the efficient operation of 5G-enabled devices. This trend indicates that the System-in-Package Die Market is likely to expand as manufacturers seek to develop cutting-edge solutions for the burgeoning 5G ecosystem.

Rising Demand for Consumer Electronics

The System-in-Package Die Market is experiencing a notable surge in demand driven by the proliferation of consumer electronics. As devices such as smartphones, tablets, and wearables become increasingly sophisticated, the need for compact and efficient packaging solutions intensifies. In 2025, the consumer electronics sector is projected to reach a valuation of approximately 1 trillion USD, with a significant portion attributed to advanced packaging technologies. System-in-Package solutions offer enhanced performance and reduced form factors, making them ideal for modern electronic applications. This trend suggests that manufacturers are likely to invest heavily in System-in-Package technologies to meet consumer expectations for high-performance devices. Consequently, the System-in-Package Die Market is poised for substantial growth as it aligns with the evolving landscape of consumer electronics.

Growing Internet of Things Applications

The System-in-Package Die Market is being propelled by the rapid expansion of Internet of Things (IoT) applications. As industries increasingly adopt IoT solutions, the demand for compact and efficient packaging technologies rises. In 2025, the IoT market is projected to reach approximately 1.5 trillion USD, with a significant portion relying on System-in-Package technologies for their devices. These solutions facilitate the integration of sensors, communication modules, and processing units into a single package, thereby optimizing space and performance. The increasing need for smart devices across various sectors, including healthcare, automotive, and industrial automation, suggests that the System-in-Package Die Market will experience robust growth as it supports the development of innovative IoT applications.

Advancements in Semiconductor Technology

The System-in-Package Die Market is significantly influenced by ongoing advancements in semiconductor technology. Innovations such as 3D integration and heterogeneous integration are reshaping the landscape of semiconductor packaging. These advancements enable the integration of multiple functionalities within a single package, thereby enhancing performance and reducing power consumption. In 2025, the semiconductor market is expected to exceed 600 billion USD, with System-in-Package solutions playing a crucial role in this growth. The ability to combine various components, such as sensors, processors, and memory, into a single package is becoming increasingly attractive for manufacturers. This trend indicates that the System-in-Package Die Market will likely see increased adoption as companies seek to leverage these technological advancements to create more efficient and powerful electronic devices.

Increased Focus on Automotive Electronics

The System-in-Package Die Market is significantly influenced by the rising focus on automotive electronics. As vehicles become more technologically advanced, the demand for efficient and reliable packaging solutions grows. In 2025, the automotive electronics market is projected to reach around 400 billion USD, with System-in-Package technologies playing a pivotal role in this evolution. These solutions facilitate the integration of various electronic components, such as sensors, control units, and communication modules, into a single package, enhancing performance and reliability. The increasing adoption of electric vehicles and autonomous driving technologies suggests that the System-in-Package Die Market will likely experience substantial growth as it supports the development of next-generation automotive systems.