Emergence of Remote Work Culture

The Technical Support Outsourcing Market is being shaped by the emergence of a remote work culture. As organizations adapt to flexible work arrangements, the demand for remote technical support services has surged. This shift has led to an increased reliance on outsourcing, as companies seek to provide uninterrupted support to their remote workforce. Recent findings indicate that businesses utilizing outsourced technical support for remote teams report a 25% increase in employee satisfaction. This trend underscores the importance of accessible and efficient support solutions in the current work environment. As remote work continues to be a prevalent model, the Technical Support Outsourcing Market is poised for further expansion.

Growing Complexity of IT Systems

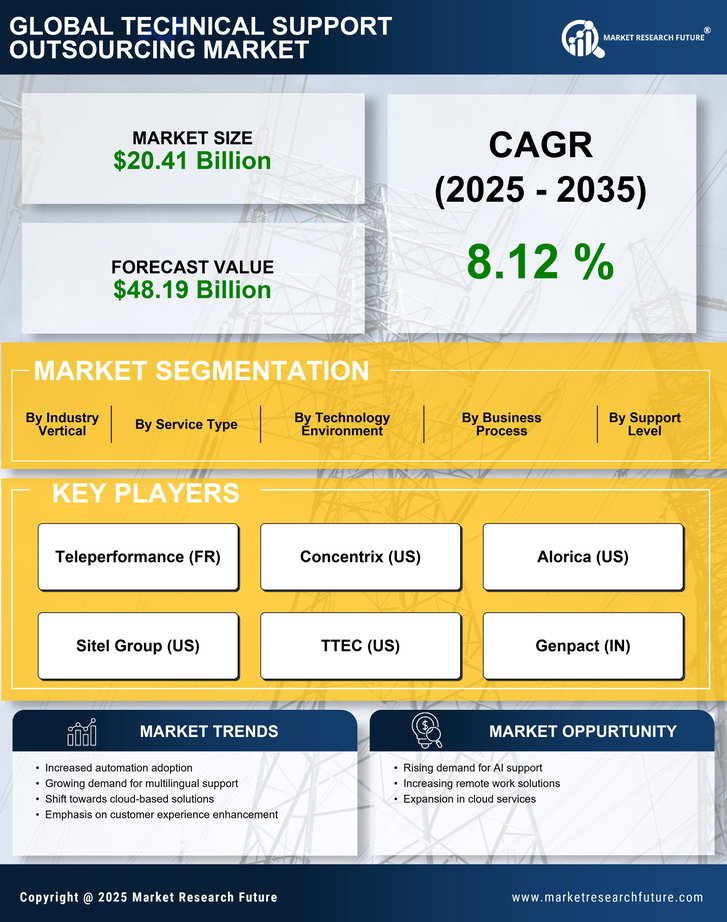

The Technical Support Outsourcing Market is being propelled by the growing complexity of IT systems. As organizations adopt more sophisticated technologies, the demand for specialized technical support has surged. This complexity necessitates a higher level of expertise, which many companies find challenging to maintain in-house. Consequently, businesses are increasingly turning to outsourcing as a viable solution. Recent statistics suggest that the market for IT support services is projected to grow at a compound annual growth rate of 8% over the next five years. This trend indicates a robust opportunity for the Technical Support Outsourcing Market to expand its offerings and cater to the evolving needs of businesses.

Rising Demand for Cost Efficiency

The Technical Support Outsourcing Market is experiencing a notable increase in demand for cost efficiency among businesses. Companies are increasingly recognizing the financial benefits of outsourcing technical support functions, which can lead to substantial savings on operational costs. According to recent data, organizations that outsource their technical support can save up to 30% on labor costs. This trend is particularly pronounced in sectors such as information technology and telecommunications, where the need for specialized support is critical. As businesses strive to enhance their bottom line, the Technical Support Outsourcing Market is likely to see continued growth driven by this focus on cost reduction.

Advancements in Communication Technologies

The Technical Support Outsourcing Market is significantly influenced by advancements in communication technologies. Innovations such as VoIP, chatbots, and video conferencing tools have transformed the way technical support is delivered. These technologies enable support teams to provide real-time assistance, thereby improving response times and customer satisfaction. Data indicates that companies utilizing advanced communication tools in their support operations report a 20% increase in customer retention rates. As these technologies continue to evolve, they are expected to further enhance the efficiency and effectiveness of the Technical Support Outsourcing Market, making it an attractive option for businesses seeking to improve their service delivery.

Increased Focus on Core Business Functions

The Technical Support Outsourcing Market is benefiting from an increased focus on core business functions among organizations. Companies are recognizing the importance of concentrating on their primary competencies while outsourcing non-core activities, such as technical support. This strategic shift allows businesses to allocate resources more effectively and enhance overall productivity. Data shows that organizations that outsource their technical support functions experience a 15% improvement in operational efficiency. As more companies adopt this approach, the Technical Support Outsourcing Market is likely to witness sustained growth, driven by the desire to streamline operations and focus on strategic initiatives.