Market Trends

Key Emerging Trends in the Temperature Sensors Market

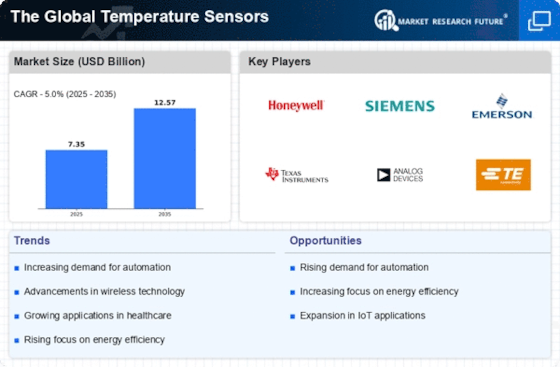

The Global Temperature Sensors Market is experiencing significant trends driven by the increasing demand for precise and reliable temperature monitoring across various industries. One notable trend is the widespread adoption of contactless temperature sensing technologies. In response to global health concerns, non-contact temperature sensors, such as infrared thermometers, are being increasingly utilized for fever screening and temperature measurement in public spaces, workplaces, and healthcare settings. This trend aligns with the heightened focus on health and safety, driving the integration of advanced temperature sensing solutions to monitor and mitigate potential health risks.

Additionally, the Industrial Internet of Things (IIoT) is playing a pivotal role in shaping the Temperature Sensors Market. Industries are leveraging sensor data to optimize processes, improve efficiency, and enhance overall operational performance. Temperature sensors, integrated with IoT platforms, enable real-time monitoring and data analytics, facilitating predictive maintenance and ensuring optimal operating conditions in industrial environments. This trend is particularly prominent in sectors like manufacturing, energy, and logistics, where temperature-sensitive processes and assets require precise temperature control.

The automotive industry is a key driver of innovation in temperature sensing technologies. With the increasing electrification of vehicles, there is a growing demand for accurate temperature monitoring in battery systems, power electronics, and thermal management systems. Advanced temperature sensors are essential for ensuring the safety and efficiency of electric vehicles (EVs) and hybrid electric vehicles (HEVs). The automotive sector's emphasis on sustainability and energy efficiency is further driving the adoption of temperature sensors to optimize thermal management and enhance the performance of electric drivetrains.

Moreover, the demand for miniaturized and wireless temperature sensing solutions is on the rise. As devices and applications become smaller and more portable, there is a need for compact and unobtrusive temperature sensors. Manufacturers are developing miniature sensors with wireless connectivity to enable seamless integration into various consumer electronics, medical devices, and wearables. This trend reflects the ongoing pursuit of enhanced functionality without compromising space and design considerations.

Environmental monitoring and climate research are driving the adoption of temperature sensors in meteorological applications. As concerns about climate change intensify, there is a growing need for accurate and reliable temperature data to track and understand environmental changes. Temperature sensors are employed in weather stations, satellite-based monitoring systems, and climate research initiatives to gather crucial temperature data, contributing to a better understanding of global climate patterns.

The integration of smart features and artificial intelligence (AI) capabilities in temperature sensors is another noteworthy trend. Smart temperature sensors can autonomously adjust to changing conditions, optimize energy consumption, and provide predictive insights based on historical data. The combination of temperature sensing with AI algorithms enables more intelligent and adaptive control of HVAC systems, climate control in smart buildings, and energy-efficient temperature management across diverse applications.

Furthermore, the healthcare sector is a significant contributor to the growth of the Temperature Sensors Market. The demand for precise temperature monitoring is evident in medical devices, laboratories, and pharmaceutical storage. Temperature sensors play a critical role in maintaining the integrity of temperature-sensitive medications, vaccines, and biological samples. With the increasing focus on healthcare digitization, temperature sensors are becoming integral components of connected healthcare solutions, ensuring the safe storage and transportation of medical supplies.

Leave a Comment