North America : Innovation and Market Leadership

North America continues to lead the Test & Measurement Equipment Market, holding a significant share of 14600.0. The region's growth is driven by rapid technological advancements, increased R&D investments, and a strong focus on quality assurance across various industries. Regulatory support and government initiatives further catalyze market expansion, ensuring compliance with stringent standards and fostering innovation.

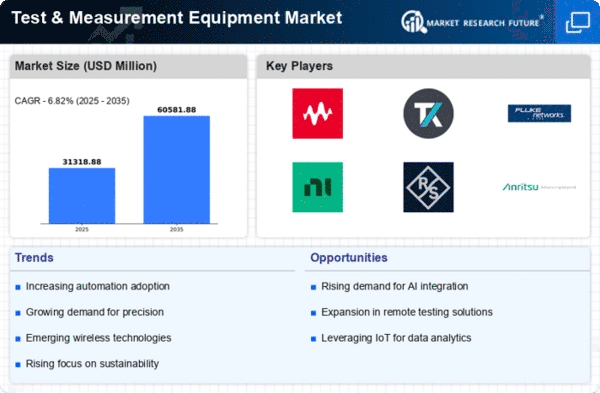

The competitive landscape is robust, with key players like Keysight Technologies, Tektronix, and Fluke Corporation dominating the market. The U.S. stands out as a leader, supported by a well-established infrastructure and a high demand for advanced testing solutions. The presence of major companies enhances the region's capability to innovate and meet the evolving needs of various sectors, including telecommunications, aerospace, and automotive.

Europe : Growing Demand and Innovation

Europe's Test & Measurement Equipment Market is projected to reach 9000.0, driven by increasing demand for precision instruments and compliance with regulatory standards. The region benefits from a strong manufacturing base and a focus on innovation, particularly in sectors like automotive and telecommunications. Government initiatives aimed at enhancing technological capabilities and sustainability are also key growth drivers, fostering a favorable environment for market expansion.

Leading countries such as Germany, the UK, and France are at the forefront of this growth, with a competitive landscape featuring major players like Rohde & Schwarz and Agilent Technologies. The presence of advanced research institutions and a skilled workforce further bolster the region's market position. As industries increasingly adopt automation and smart technologies, the demand for sophisticated testing solutions is expected to rise significantly.

Asia-Pacific : Emerging Markets and Growth Potential

The Asia-Pacific region is witnessing a burgeoning Test & Measurement Equipment Market, projected to reach 5000.0. This growth is fueled by rapid industrialization, increasing investments in technology, and a rising demand for quality assurance across various sectors. Countries like China and India are leading this trend, supported by government initiatives aimed at enhancing manufacturing capabilities and technological advancements.

China, Japan, and India are the primary contributors to this market, with a competitive landscape that includes key players like Anritsu and Tektronix. The region's focus on smart manufacturing and the Internet of Things (IoT) is driving the demand for advanced testing solutions. As industries evolve, the need for reliable and efficient test equipment is becoming increasingly critical, positioning Asia-Pacific as a key player in the global market.

Middle East and Africa : Emerging Opportunities and Challenges

The Middle East & Africa region is gradually developing its Test & Measurement Equipment Market, with a size of 1719.3. The growth is primarily driven by increasing investments in infrastructure and technology, alongside a rising demand for quality assurance in various industries. Government initiatives aimed at enhancing technological capabilities and fostering innovation are also contributing to market expansion, despite challenges such as economic fluctuations and regulatory hurdles.

Countries like South Africa and the UAE are leading the market, with a competitive landscape that includes both local and international players. The presence of key companies is essential for driving innovation and meeting the growing demand for advanced testing solutions. As the region continues to invest in technology and infrastructure, the Test & Measurement Equipment Market is expected to see significant growth in the coming years.

Leave a Comment