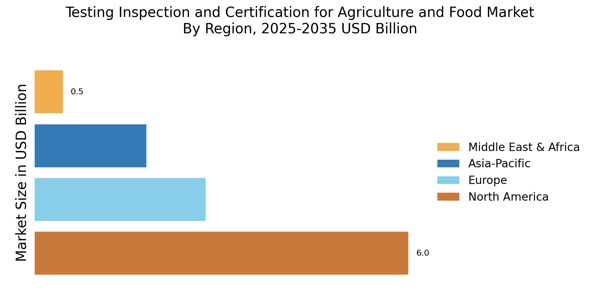

North America : Regulatory Compliance Leader

North America is witnessing robust growth in the Testing, Inspection, and Certification (TIC) market for agriculture and food, driven by stringent regulatory frameworks and increasing consumer awareness regarding food safety. The United States holds the largest market share at approximately 60%, followed by Canada at around 25%. The demand for certified organic and non-GMO products is propelling this growth, alongside government initiatives promoting food safety standards.

The competitive landscape is dominated by key players such as SGS, Bureau Veritas, and Intertek, which have established a strong presence in the region. The U.S. Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) play crucial roles in regulating food safety, further enhancing the demand for TIC services. The market is characterized by continuous innovation and investment in technology to improve testing methodologies and efficiency.

Europe : Innovation and Sustainability Focus

Europe is a significant player in the Testing, Inspection, and Certification (TIC) market for agriculture and food, driven by a strong emphasis on sustainability and food safety regulations. The European Union's stringent regulations, such as the General Food Law, ensure high standards, with Germany and France being the largest markets, holding approximately 30% and 25% market shares, respectively. The increasing demand for organic and sustainably sourced products is a key growth driver in this region.

Leading countries like Germany, France, and the UK are home to major TIC players such as Eurofins Scientific and TÜV SÜD. The competitive landscape is marked by innovation, with companies investing in advanced testing technologies to meet evolving consumer demands. The European Commission's commitment to enhancing food safety and quality standards further supports market expansion, fostering a robust environment for TIC services.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging as a key market for Testing, Inspection, and Certification (TIC) services in agriculture and food, driven by increasing urbanization and rising disposable incomes. China and India are the largest markets, accounting for approximately 40% and 20% of the market share, respectively. The growing awareness of food safety and quality among consumers is propelling demand for TIC services, supported by government initiatives aimed at enhancing food safety regulations.

Countries like China, India, and Japan are witnessing significant investments in TIC services, with key players such as ALS Limited and Intertek expanding their operations. The competitive landscape is evolving, with local companies entering the market, increasing competition. The region's diverse agricultural landscape presents unique challenges and opportunities for TIC providers, making it a dynamic market for growth.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa (MEA) region is experiencing a growing demand for Testing, Inspection, and Certification (TIC) services in agriculture and food, driven by increasing food safety concerns and regulatory developments. The market is characterized by a diverse landscape, with South Africa and the UAE being the largest markets, holding approximately 30% and 20% market shares, respectively. The region's focus on improving food safety standards is a key driver of market growth, supported by government initiatives and international partnerships.

Leading countries like South Africa and the UAE are witnessing significant investments in TIC services, with key players such as Bureau Veritas and DNV GL establishing a strong presence. The competitive landscape is evolving, with local firms emerging to meet the growing demand for food safety and quality assurance. The region's unique challenges, including climate variability and resource management, present opportunities for TIC providers to innovate and expand their services.