E-commerce Growth

The rapid expansion of e-commerce has significantly impacted the Testing, Inspection and Certification in Consumer Goods and Retail Market. As online shopping becomes increasingly prevalent, consumers are more concerned about the authenticity and safety of products purchased online. This has led to a heightened demand for third-party testing and certification services to validate product claims and ensure compliance with safety standards. According to recent data, e-commerce sales have surged, with projections indicating a continued upward trajectory. Consequently, retailers and manufacturers are prioritizing certification to enhance their credibility and attract discerning consumers. This trend underscores the necessity for robust testing and inspection processes to mitigate risks associated with online transactions.

Technological Integration

The integration of advanced technologies is transforming the Testing, Inspection and Certification in Consumer Goods and Retail Market. Innovations such as artificial intelligence, blockchain, and the Internet of Things are streamlining testing processes and enhancing accuracy. For instance, AI-driven analytics can predict potential product failures, allowing for proactive testing and quality assurance. Additionally, blockchain technology is being utilized to create transparent supply chains, ensuring that products are traceable and compliant with safety standards. This technological evolution not only improves efficiency but also reduces costs associated with testing and certification. As companies adopt these technologies, the demand for sophisticated testing services is likely to increase, reshaping the landscape of the industry.

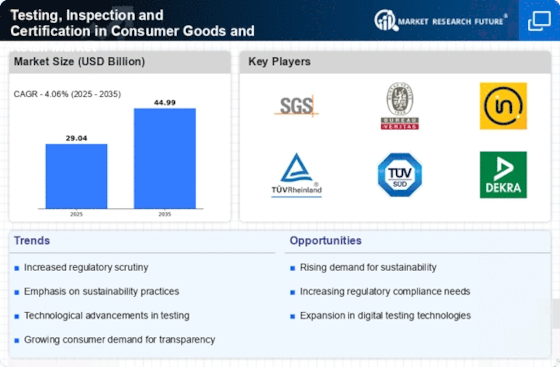

Sustainability Initiatives

Sustainability has emerged as a pivotal driver in the Testing, Inspection and Certification in Consumer Goods and Retail Market. With growing environmental concerns, consumers and businesses alike are prioritizing sustainable practices. This shift is prompting companies to seek certification for eco-friendly products and processes, thereby enhancing their market appeal. Data indicates that a substantial portion of consumers prefer products that are certified as sustainable, which has led to an increase in demand for testing services that assess environmental impact. Furthermore, regulatory bodies are increasingly requiring sustainability certifications, compelling businesses to adapt their practices accordingly. This trend not only fosters responsible consumption but also drives innovation in testing methodologies, as companies strive to meet sustainability standards.

Regulatory Compliance Pressure

The Testing, Inspection and Certification in Consumer Goods and Retail Market is increasingly influenced by stringent regulatory frameworks. Governments and regulatory bodies are imposing more rigorous standards to ensure product safety and quality. This trend is particularly evident in sectors such as food and beverages, electronics, and textiles, where compliance with safety regulations is paramount. For instance, the introduction of the General Product Safety Directive in various regions has necessitated enhanced testing protocols. As a result, companies are compelled to invest in comprehensive testing and certification processes to avoid penalties and maintain market access. This regulatory pressure not only drives demand for testing services but also fosters a culture of quality assurance within organizations, thereby enhancing consumer trust.

Consumer Demand for Quality Assurance

In the Testing, Inspection and Certification in Consumer Goods and Retail Market, there is a marked increase in consumer demand for quality assurance. Modern consumers are more informed and discerning, often seeking products that have been rigorously tested and certified. This shift in consumer behavior is driving companies to prioritize quality control measures and invest in certification processes. Data suggests that a significant percentage of consumers are willing to pay a premium for certified products, indicating a strong market incentive for businesses to enhance their testing and inspection protocols. As a result, organizations are increasingly collaborating with certification bodies to ensure their products meet the evolving expectations of quality and safety.