Regulatory Support for Biologics

Regulatory frameworks are increasingly supportive of biologics, which is a crucial factor for the Therapeutic Proteins And Oral Vaccines Market. Agencies are streamlining approval processes for therapeutic proteins and oral vaccines, thereby facilitating quicker access to the market. Recent initiatives have been introduced to expedite the review of biologics, particularly those addressing unmet medical needs. This regulatory environment encourages pharmaceutical companies to invest in the development of innovative therapies. As a result, the Therapeutic Proteins And Oral Vaccines Market is likely to experience accelerated growth, with a broader range of products becoming available to healthcare providers and patients.

Rising Prevalence of Chronic Diseases

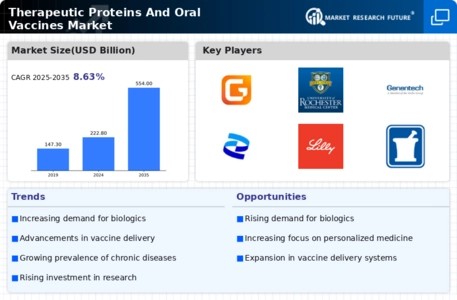

The increasing incidence of chronic diseases such as diabetes, cancer, and autoimmune disorders is driving the Therapeutic Proteins And Oral Vaccines Market. As these conditions become more prevalent, there is a heightened demand for innovative therapeutic solutions. Therapeutic proteins, including monoclonal antibodies and recombinant proteins, are gaining traction due to their targeted action and efficacy. According to recent estimates, the therapeutic proteins market is projected to reach approximately USD 300 billion by 2025, reflecting a compound annual growth rate of around 8%. This growth is indicative of the urgent need for effective treatments, thereby propelling the Therapeutic Proteins And Oral Vaccines Market forward.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is reshaping the Therapeutic Proteins And Oral Vaccines Market. As healthcare systems prioritize prevention over treatment, there is a growing emphasis on vaccines and therapeutic proteins that can preemptively address health issues. This trend is evident in the rising demand for oral vaccines, which offer ease of administration and improved patient compliance. Market analysts project that the oral vaccine segment could witness a growth rate of over 10% annually through 2025. This focus on prevention not only enhances public health outcomes but also drives innovation within the Therapeutic Proteins And Oral Vaccines Market.

Technological Innovations in Drug Development

Technological advancements in drug development are significantly influencing the Therapeutic Proteins And Oral Vaccines Market. Innovations such as CRISPR gene editing, high-throughput screening, and artificial intelligence are streamlining the discovery and production of therapeutic proteins. These technologies enhance the efficiency of clinical trials and reduce time-to-market for new therapies. For instance, the integration of AI in drug design has shown potential to decrease development costs by up to 30%. As a result, the market is witnessing an influx of novel therapeutic proteins and oral vaccines, catering to diverse therapeutic areas and expanding the overall market landscape.

Growing Investment in Biopharmaceutical Research

The surge in investment directed towards biopharmaceutical research is a pivotal driver for the Therapeutic Proteins And Oral Vaccines Market. Governments and private entities are increasingly funding research initiatives aimed at developing advanced therapeutic proteins and oral vaccines. In 2025, it is anticipated that global investment in biopharmaceutical R&D will exceed USD 200 billion, reflecting a robust commitment to innovation. This financial backing not only accelerates the development of new therapies but also fosters collaboration among research institutions, thereby enhancing the overall efficacy and safety of therapeutic proteins. Such investments are likely to yield a diverse array of products in the Therapeutic Proteins And Oral Vaccines Market.

.png)