Regulatory Compliance

Regulatory compliance is a significant driver in the Thermoset Composite Market, as manufacturers must adhere to stringent safety and environmental standards. Various regulations govern the use of materials in industries such as aerospace, automotive, and construction, necessitating the development of compliant thermoset composites. These regulations often focus on reducing emissions, enhancing safety, and promoting recyclability. As a result, companies are investing in research and development to create materials that not only meet these requirements but also offer superior performance characteristics. The increasing emphasis on compliance is likely to spur innovation within the Thermoset Composite Market, as manufacturers seek to differentiate their products while ensuring adherence to regulations. This dynamic could lead to the emergence of new market players and the expansion of existing companies, ultimately shaping the competitive landscape.

Sustainability Initiatives

The Thermoset Composite Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, manufacturers are compelled to adopt eco-friendly practices. This shift is evident in the development of bio-based thermoset composites, which utilize renewable resources. The market for these materials is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. Companies are investing in research to enhance the recyclability of thermoset composites, which traditionally posed challenges due to their cross-linked structure. This focus on sustainability not only meets regulatory requirements but also aligns with consumer preferences for greener products. Consequently, the Thermoset Composite Market is likely to witness a transformation as it adapts to these evolving demands, potentially leading to new market opportunities and innovations.

Technological Advancements

Technological advancements play a pivotal role in shaping the Thermoset Composite Market. Innovations in manufacturing processes, such as automated fiber placement and advanced curing techniques, enhance the efficiency and quality of thermoset composites. These advancements enable the production of lightweight and high-performance materials, which are increasingly sought after in various sectors, including aerospace and automotive. The market is witnessing a surge in the adoption of computer-aided design and simulation tools, which facilitate the development of complex composite structures. Furthermore, the integration of smart technologies, such as sensors within composites, is emerging as a trend that could redefine applications. As these technologies evolve, they are expected to drive growth in the Thermoset Composite Market, potentially leading to enhanced product performance and expanded application areas.

Market Expansion in Emerging Economies

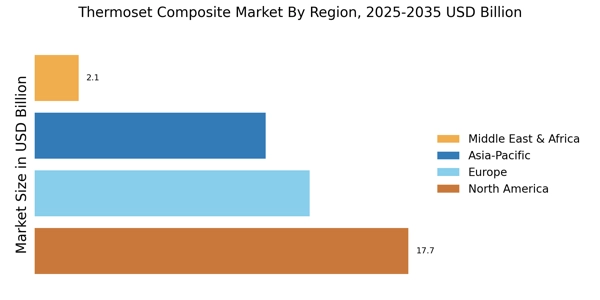

The Thermoset Composite Market is poised for expansion in emerging economies, where industrialization and infrastructure development are accelerating. Countries in Asia-Pacific and Latin America are witnessing a surge in demand for thermoset composites, driven by growth in construction, automotive, and aerospace sectors. The increasing investment in infrastructure projects, such as bridges and buildings, is creating opportunities for thermoset composites due to their durability and lightweight properties. Additionally, the automotive industry in these regions is evolving, with a growing focus on electric vehicles and fuel-efficient designs. This trend is likely to enhance the adoption of thermoset composites, as manufacturers seek materials that meet performance and regulatory standards. As these markets develop, the Thermoset Composite Market may experience a shift in dynamics, with new players entering and existing companies expanding their reach.

Growing Demand in Aerospace and Automotive

The Thermoset Composite Market is experiencing robust growth driven by increasing demand in the aerospace and automotive sectors. The aerospace industry, in particular, is leveraging thermoset composites for their lightweight and high-strength properties, which contribute to fuel efficiency and performance. Reports indicate that the aerospace segment is projected to account for a substantial share of the thermoset composite market, with a growth rate exceeding 8% annually. Similarly, the automotive sector is adopting these materials to meet stringent regulations regarding emissions and fuel economy. The shift towards electric vehicles further amplifies this demand, as manufacturers seek lightweight solutions to enhance battery efficiency. This trend underscores the critical role of thermoset composites in advancing technological capabilities within the Thermoset Composite Market, potentially leading to innovative applications and increased market penetration.