Government Initiatives and Regulations

Government initiatives aimed at promoting smart transportation are significantly influencing the Two-wheeler Connectivity System Market. Various countries are implementing regulations that encourage the adoption of connected vehicles to enhance road safety and reduce traffic congestion. For instance, initiatives that mandate the installation of advanced safety features in two-wheelers are becoming more prevalent. These regulations are often accompanied by incentives for manufacturers and consumers alike, fostering a conducive environment for the growth of connectivity systems. Data suggests that regions with stringent safety regulations are witnessing a surge in the adoption of connected two-wheelers, as compliance becomes a priority for manufacturers. This regulatory landscape not only drives innovation but also ensures that the Two-wheeler Connectivity System Market aligns with broader safety and environmental goals.

Growth of E-commerce and Delivery Services

The growth of e-commerce and delivery services is emerging as a significant driver for the Two-wheeler Connectivity System Market. With the rise of online shopping, there is an increasing reliance on two-wheelers for last-mile delivery solutions. Delivery companies are seeking efficient and reliable vehicles that can navigate urban environments swiftly. The integration of connectivity systems in two-wheelers enhances route optimization, real-time tracking, and communication between delivery personnel and customers. Market data reveals that the demand for delivery services has surged, leading to a corresponding increase in the adoption of connected two-wheelers. This trend suggests that the Two-wheeler Connectivity System Market is likely to expand as businesses invest in technology to improve operational efficiency and customer satisfaction.

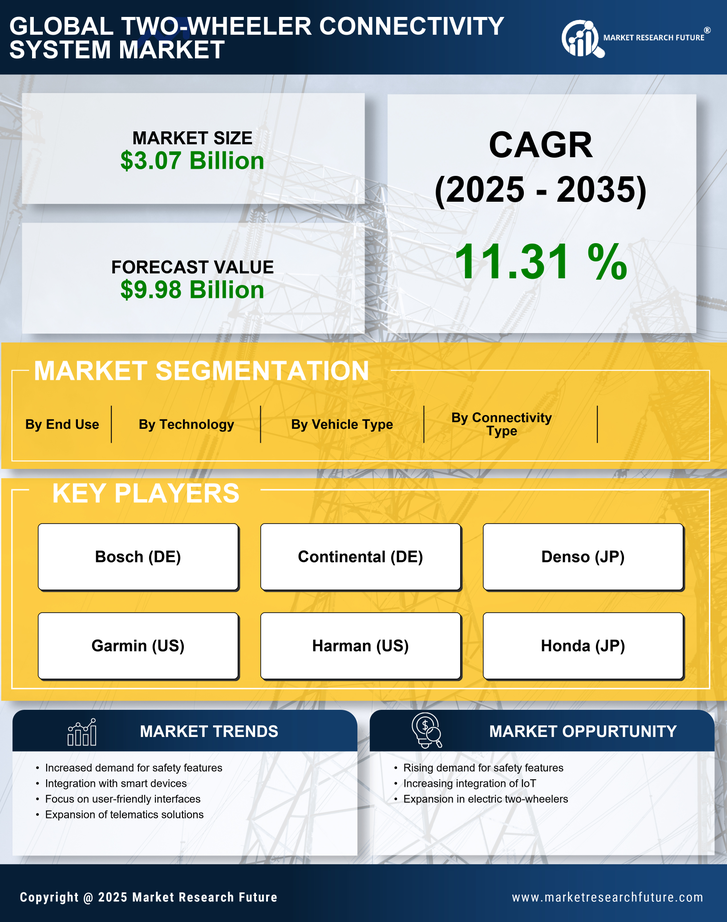

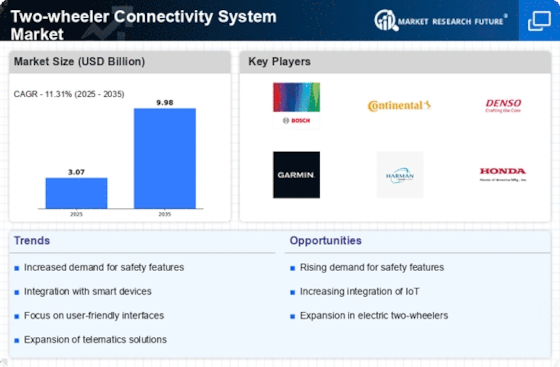

Rising Demand for Smart Mobility Solutions

The increasing demand for smart mobility solutions is a pivotal driver for the Two-wheeler Connectivity System Market. As urbanization accelerates, consumers are seeking efficient and technologically advanced transportation options. The integration of connectivity features in two-wheelers, such as GPS navigation, real-time traffic updates, and vehicle diagnostics, enhances user experience and convenience. According to recent data, the market for smart mobility solutions is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates a robust appetite for connected two-wheelers, which are perceived as not only a mode of transport but also as a lifestyle choice. Consequently, manufacturers are increasingly investing in connectivity technologies to meet consumer expectations, thereby propelling the Two-wheeler Connectivity System Market forward.

Technological Advancements in Connectivity

Technological advancements in connectivity are a crucial driver for the Two-wheeler Connectivity System Market. Innovations such as 5G technology, Internet of Things (IoT), and artificial intelligence are transforming the way two-wheelers communicate with users and other vehicles. These technologies enable features like remote diagnostics, predictive maintenance, and enhanced navigation systems, which are increasingly appealing to tech-savvy consumers. The integration of these advanced technologies is expected to enhance the overall riding experience, making two-wheelers more attractive to a wider audience. Market data indicates that the adoption of IoT-enabled devices in two-wheelers is expected to increase significantly, with projections suggesting a growth rate of over 15% annually. This technological evolution is likely to redefine the Two-wheeler Connectivity System Market, pushing manufacturers to innovate continuously.

Consumer Preference for Enhanced Safety Features

Consumer preference for enhanced safety features is driving the Two-wheeler Connectivity System Market. As awareness of road safety increases, riders are prioritizing vehicles equipped with advanced safety technologies. Features such as anti-lock braking systems, traction control, and connectivity for emergency services are becoming essential for consumers. Market Research Future indicates that nearly 60% of potential buyers consider safety features as a primary factor in their purchasing decisions. This shift in consumer behavior is prompting manufacturers to integrate more sophisticated safety systems into their two-wheelers. Consequently, the demand for connectivity systems that support these safety features is on the rise, indicating a strong correlation between consumer preferences and the growth of the Two-wheeler Connectivity System Market.