Supportive Policy Frameworks

The UK government has established a supportive policy framework that encourages the growth of the energy storage market. Initiatives such as the Contracts for Difference (CfD) scheme and the Capacity Market are designed to incentivize investments in energy storage technologies. These policies aim to promote the integration of renewable energy and enhance grid stability. In 2025, the government is expected to introduce additional measures to facilitate the deployment of energy storage systems, including financial incentives and regulatory support. This conducive environment is likely to attract both domestic and international investors, further driving the expansion of the energy storage market.

Growing Demand for Renewable Energy

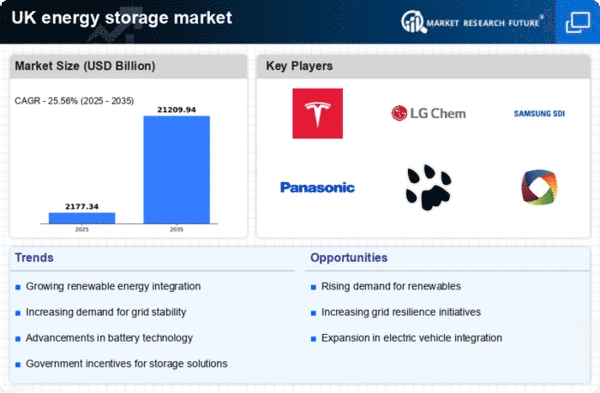

The increasing emphasis on renewable energy sources in the UK is a primary driver for the energy storage market. As the government aims to achieve net-zero emissions by 2050, the integration of renewable energy, such as wind and solar, becomes crucial. Energy storage systems are essential for managing the intermittent nature of these sources, allowing for energy to be stored during peak production times and released when demand is high. In 2025, renewable energy accounted for approximately 48% of the UK's electricity generation, highlighting the need for robust energy storage solutions to ensure grid stability and reliability. This growing demand for renewables is likely to propel investments in energy storage technologies, thereby expanding the market significantly.

Increasing Energy Security Concerns

The rising concerns over energy security in the UK are influencing the energy storage market. With geopolitical tensions and the need for a resilient energy infrastructure, energy storage systems are seen as a solution to enhance energy independence. By storing excess energy generated from renewable sources, the UK can reduce its reliance on imported fossil fuels and mitigate the risks associated with supply disruptions. In 2025, energy storage capacity in the UK is projected to reach 10 GW, reflecting a growing recognition of the importance of energy storage in ensuring a stable and secure energy supply. This trend is likely to encourage further investments in energy storage technologies, thereby bolstering the market.

Rising Consumer Awareness and Adoption

Consumer awareness regarding energy efficiency and sustainability is on the rise in the UK, which is positively impacting the energy storage market. As households and businesses become more conscious of their energy consumption, there is a growing interest in energy storage solutions that can help reduce energy bills and carbon footprints. In 2025, it is estimated that around 30% of UK households are considering the installation of energy storage systems alongside solar panels. This trend indicates a shift towards more sustainable energy practices and is likely to drive demand for energy storage technologies. As consumers increasingly seek out energy independence, the energy storage market is expected to experience substantial growth.

Technological Advancements in Storage Solutions

Technological innovations in energy storage systems are transforming the energy storage market. Advancements in battery technologies, such as lithium-ion and solid-state batteries, are enhancing energy density, efficiency, and lifespan. These improvements are making energy storage systems more economically viable for both residential and commercial applications. In 2025, the cost of lithium-ion batteries has decreased by approximately 80% since 2010, making them a more attractive option for energy storage. Furthermore, the development of new materials and chemistries could lead to even more efficient storage solutions in the near future. As these technologies continue to evolve, they are expected to drive growth in the energy storage market, enabling broader adoption across various sectors.