Increased Focus on Customer Experience

An increased focus on customer experience is significantly influencing the intelligent document-processing market. Organizations are striving to enhance customer interactions by streamlining document-related processes, thereby reducing response times and improving service quality. In the UK, businesses that implement intelligent document-processing solutions report a 20% improvement in customer satisfaction scores. This emphasis on customer experience is prompting companies to invest in technologies that facilitate faster and more accurate document handling. As customer expectations evolve, the intelligent document-processing market is likely to see sustained growth, driven by the need to deliver superior service and engagement.

Growing Need for Enhanced Data Analytics

The intelligent document-processing market is being propelled by the growing need for enhanced data analytics capabilities. Organizations are recognizing the value of extracting insights from unstructured data contained within documents. By leveraging intelligent document-processing technologies, businesses can convert vast amounts of data into actionable insights, which is essential for strategic decision-making. In the UK, the market for data analytics is expected to reach £2 billion by 2026, indicating a strong correlation with the adoption of intelligent document-processing solutions. This trend suggests that as companies seek to harness the power of data, the intelligent document-processing market will continue to expand, driven by the demand for sophisticated analytics.

Rising Demand for Operational Efficiency

The intelligent document-processing market is experiencing a notable surge in demand for operational efficiency across various sectors in the UK. Businesses are increasingly seeking solutions that streamline workflows, reduce manual intervention, and enhance productivity. According to recent data, companies that implement intelligent document-processing solutions can achieve up to 30% reduction in processing time. This drive towards efficiency is particularly evident in industries such as finance and healthcare, where the volume of documents is substantial. As organizations strive to remain competitive, the adoption of intelligent document-processing technologies is likely to become a cornerstone of operational strategy, thereby propelling market growth.

Regulatory Compliance and Risk Management

Regulatory compliance remains a critical driver in the intelligent document-processing market, particularly in the UK, where businesses face stringent regulations across various sectors. Organizations are increasingly adopting intelligent document-processing solutions to ensure compliance with data protection laws, such as the General Data Protection Regulation (GDPR). The ability to automate compliance-related documentation reduces the risk of human error and potential penalties. As the regulatory landscape continues to evolve, the demand for solutions that facilitate compliance is likely to grow, thereby influencing the intelligent document-processing market positively. Companies that prioritize compliance through intelligent document-processing are better positioned to mitigate risks and enhance their reputational standing.

Integration of Artificial Intelligence Technologies

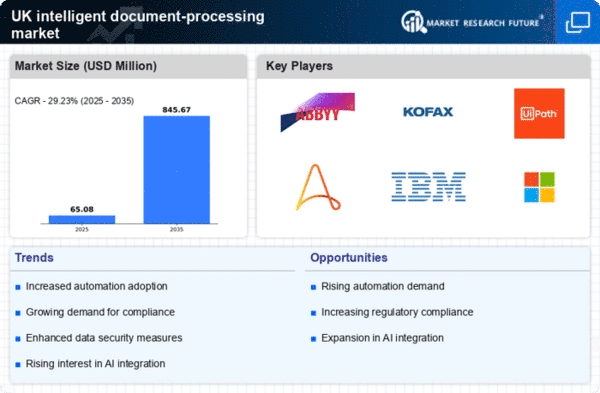

The integration of artificial intelligence (AI) technologies into the intelligent document-processing market is transforming how organizations manage their documentation. AI capabilities, such as machine learning and natural language processing, enable systems to understand and process documents with greater accuracy. In the UK, the market is projected to grow at a CAGR of 25% over the next five years, driven by advancements in AI. This integration not only enhances the speed of document processing but also improves data extraction accuracy, which is crucial for compliance and decision-making. As AI continues to evolve, its impact on the intelligent document-processing market is expected to deepen, fostering innovation and efficiency.