Advancements in Network Infrastructure

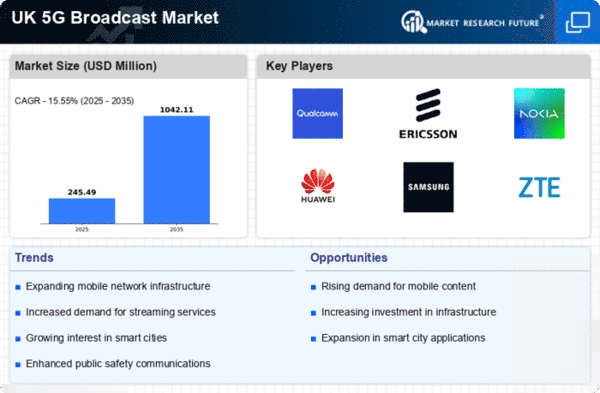

The lte 5g-broadcast market is being propelled by significant advancements in network infrastructure. The rollout of 5G technology across the UK has enhanced the capabilities of mobile networks, enabling faster data transmission and improved connectivity. According to recent reports, 5G coverage in urban areas has reached approximately 80%, facilitating the deployment of advanced broadcasting solutions. This infrastructure upgrade allows for more efficient use of spectrum and supports a higher number of simultaneous users, which is essential for live broadcasting events. As network operators continue to invest in infrastructure improvements, the lte 5g-broadcast market is likely to see increased adoption of innovative broadcasting technologies, further enhancing the viewer experience and expanding service offerings.

Growing Demand for High-Quality Streaming

The lte 5g-broadcast market is experiencing a surge in demand for high-quality streaming services. As consumers increasingly seek seamless and high-definition content, the need for robust broadcasting solutions becomes paramount. In the UK, the number of households subscribing to streaming services has risen significantly, with estimates suggesting a growth of over 30% in the last two years. This trend indicates a shift in consumer behaviour, where traditional broadcasting is being supplanted by on-demand services. Consequently, the lte 5g-broadcast market is poised to benefit from this transition, as it offers the necessary infrastructure to support high-quality video delivery. The ability to broadcast content efficiently and reliably is crucial for service providers aiming to capture this expanding audience, thereby driving investment and innovation within the industry.

Regulatory Framework Supporting Innovation

the 5G broadcast market benefits from a regulatory framework that supports innovation and competition.. The UK government has implemented policies aimed at fostering technological advancements in telecommunications, which includes the promotion of 5G broadcasting. Recent initiatives have focused on streamlining the licensing process for new broadcasting technologies, making it easier for companies to enter the market. This regulatory environment encourages investment and experimentation, allowing for the rapid development of new services and applications. As the lte 5g-broadcast market continues to evolve, the supportive regulatory landscape is likely to play a crucial role in shaping its future, enabling companies to explore new business models and enhance service delivery.

Increased Investment in Media and Entertainment

The lte 5g-broadcast market is witnessing a notable increase in investment within the media and entertainment sector. As companies recognise the potential of 5G broadcasting to transform content delivery, funding for related projects has surged. In the UK, investments in media technology have reportedly exceeded £1 billion in the past year alone, reflecting a strong commitment to enhancing broadcasting capabilities. This influx of capital is likely to drive innovation, leading to the development of new applications and services that leverage the unique features of 5G technology. As a result, the lte 5g-broadcast market is expected to expand, with new players entering the field and existing companies enhancing their offerings to meet evolving consumer demands.

Consumer Preference for Mobile Content Consumption

the 5G broadcast market is significantly influenced by the growing consumer preference for mobile content consumption.. With the proliferation of smartphones and tablets, more individuals are accessing content on-the-go. Recent surveys indicate that over 60% of UK consumers prefer watching videos on mobile devices rather than traditional television. This shift in viewing habits necessitates the development of broadcasting solutions that cater specifically to mobile platforms. As a result, the lte 5g-broadcast market is likely to evolve, focusing on mobile-first strategies that enhance user experience and accessibility. This trend presents opportunities for broadcasters to innovate and create tailored content that resonates with mobile audiences, thereby driving growth within the industry.