Expansion of 5G Infrastructure

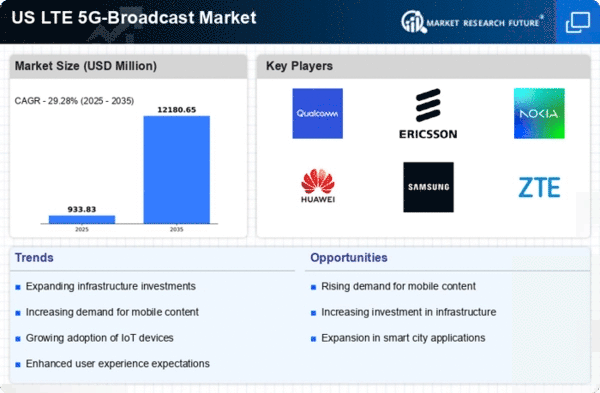

The ongoing expansion of 5G infrastructure is a pivotal driver for the US LTE and 5G Broadcast market. As telecommunications companies invest heavily in upgrading their networks, the availability of 5G services is expected to increase significantly. By 2025, it is projected that over 50% of the US population will have access to 5G networks, enhancing mobile broadband capabilities. This expansion not only facilitates faster data transmission but also supports a wider array of applications, including augmented reality and smart city initiatives. The competitive landscape among service providers further accelerates this growth, as they strive to offer superior connectivity solutions to attract and retain customers. Consequently, the expansion of 5G infrastructure is likely to reshape the telecommunications landscape, driving innovation and service diversification.

Emergence of Edge Computing Solutions

The emergence of edge computing solutions is becoming a critical driver for the US LTE and 5G Broadcast market. As data generation accelerates, the need for real-time processing and analysis at the network edge is increasingly recognized. Edge computing reduces latency and bandwidth usage by processing data closer to the source, which is particularly beneficial for applications such as autonomous vehicles and industrial automation. By 2025, the edge computing market is expected to grow substantially, with investments flowing into technologies that complement 5G networks. This synergy enhances the overall performance of applications reliant on low-latency connectivity, thereby driving demand for 5G services. The integration of edge computing with 5G technology is likely to unlock new possibilities and use cases, further propelling the growth of the US LTE and 5G Broadcast market.

Rising Adoption of Mobile Streaming Services

The rising adoption of mobile streaming services is transforming consumer behavior and driving the US LTE and 5G Broadcast market. With an increasing number of users opting for on-demand video and audio content, the demand for high-speed mobile data has surged. According to recent estimates, mobile video traffic is expected to account for over 75% of total mobile data traffic by 2025. This trend compels service providers to enhance their network capabilities to accommodate the growing demand for seamless streaming experiences. As 5G technology offers lower latency and higher bandwidth, it becomes an attractive option for streaming services looking to deliver high-quality content. The convergence of entertainment and telecommunications is likely to create new revenue streams and partnerships, further propelling the growth of the US LTE and 5G Broadcast market.

Increased Investment in Smart City Initiatives

Increased investment in smart city initiatives is emerging as a significant driver for the US LTE and 5G Broadcast market. As urban areas seek to enhance efficiency and sustainability, the integration of advanced technologies becomes essential. 5G networks facilitate the deployment of smart sensors, traffic management systems, and public safety applications, which are crucial for the development of smart cities. By 2025, it is anticipated that cities across the US will allocate billions of dollars towards these initiatives, creating a robust demand for reliable and high-speed connectivity. This investment not only supports urban infrastructure but also fosters economic growth and improves the quality of life for residents. The synergy between smart city projects and 5G technology is likely to drive substantial advancements in urban living, thereby influencing the trajectory of the US LTE and 5G Broadcast market.

Growing Demand for Enhanced Mobile Gaming Experiences

The growing demand for enhanced mobile gaming experiences is a notable driver for the US LTE and 5G Broadcast market. As mobile gaming continues to gain popularity, players increasingly seek high-quality graphics and low-latency interactions. The advent of 5G technology, with its promise of faster speeds and reduced lag, positions it as a game-changer for the gaming sector. By 2025, it is projected that mobile gaming revenue in the US will surpass $20 billion, further emphasizing the need for robust network capabilities. This demand encourages telecommunications companies to invest in infrastructure that can support immersive gaming experiences, including cloud gaming and augmented reality applications. The intersection of mobile gaming and advanced connectivity solutions is likely to drive innovation and competition within the US LTE and 5G Broadcast market.