Government Initiatives and Funding

Government initiatives play a crucial role in shaping the mhealth applications market. In the UK, the National Health Service (NHS) has been actively promoting digital health solutions to improve healthcare delivery. Recent funding allocations aimed at enhancing digital infrastructure and supporting innovative mhealth applications are indicative of this commitment. For instance, the NHS Long Term Plan outlines a vision for increasing the use of technology in healthcare, which includes mhealth applications. This strategic focus is expected to drive market growth, as public and private sectors collaborate to develop and implement effective solutions. The mhealth applications market is likely to benefit from these initiatives, with an anticipated increase in investment reaching £1 billion by 2026.

Rising Health Awareness Among Consumers

Consumer health awareness is on the rise, significantly impacting the mhealth applications market. With an increasing emphasis on preventive healthcare, individuals are more inclined to seek out mobile health solutions that facilitate self-management of health. The proliferation of health-related information through various channels, including social media and online platforms, has empowered consumers to take charge of their well-being. In the UK, surveys indicate that over 60% of adults are now using health apps to monitor fitness, nutrition, and overall health. This growing trend suggests a shift towards proactive health management, which is likely to drive demand for innovative mhealth applications. Consequently, the market is expected to witness a robust growth trajectory, potentially reaching £2 billion by 2025.

Technological Advancements in Mobile Devices

Technological advancements in mobile devices are significantly influencing the mhealth applications market. The continuous evolution of smartphones and tablets, equipped with advanced sensors and capabilities, has created a fertile ground for the development of sophisticated health applications. Features such as GPS tracking, heart rate monitoring, and integration with wearable devices enhance the functionality of mhealth applications, making them more appealing to users. In the UK, the smartphone penetration rate is approximately 85%, providing a vast user base for mhealth solutions. As mobile technology continues to advance, the mhealth applications market is likely to expand, with projections indicating a potential market size of £3 billion by 2027.

Increasing Demand for Remote Patient Monitoring

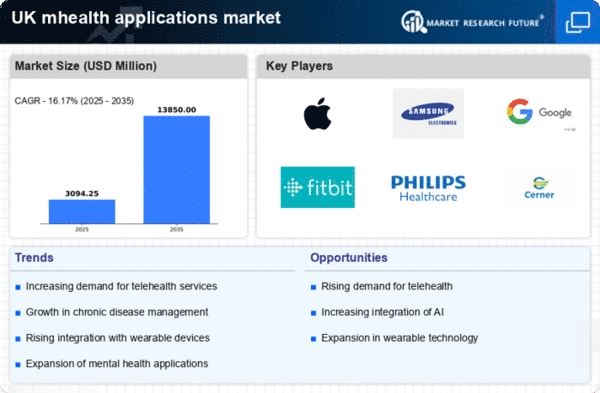

There is a notable surge in demand for remote patient monitoring solutions in the mhealth applications market. This trend is driven by the growing need for continuous health tracking, particularly among chronic disease patients. In the UK, it is estimated that around 15 million individuals live with chronic conditions, necessitating effective management strategies. Remote monitoring applications enable healthcare providers to collect real-time data, enhancing patient engagement and adherence to treatment plans. Furthermore, the integration of artificial intelligence in these applications is likely to improve predictive analytics, thereby facilitating timely interventions. As a result, the mhealth applications market is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 25% over the next five years.

Growing Focus on Personalised Healthcare Solutions

The mhealth applications market is increasingly shifting towards personalised healthcare solutions. This trend is driven by the recognition that individual health needs vary significantly, necessitating tailored approaches to treatment and management. In the UK, there is a growing demand for applications that offer customised health plans based on user data, preferences, and lifestyle choices. The integration of machine learning algorithms in mhealth applications allows for the analysis of vast amounts of data, enabling the delivery of personalised recommendations. This focus on individualised care is likely to enhance user satisfaction and engagement, thereby propelling market growth. The mhealth applications market could potentially reach £4 billion by 2028, reflecting this shift towards personalised healthcare.

Leave a Comment