Rising Demand for Reliable Power Supply

The increasing reliance on digital technologies and electronic devices in various sectors has led to a heightened demand for reliable power supply. In the power quality-equipment market, this trend is particularly pronounced as businesses seek to mitigate the risks associated with power disturbances. According to recent data, power outages can cost UK businesses up to £1.5 billion annually, underscoring the necessity for robust power quality solutions. As industries such as manufacturing and IT expand, the need for uninterrupted power becomes critical. This demand drives investments in power quality equipment, which is essential for maintaining operational efficiency and protecting sensitive electronic equipment from voltage fluctuations and harmonics.

Growing Awareness of Power Quality Issues

There is a growing awareness among businesses and consumers regarding the implications of poor power quality. This awareness is fostering a proactive approach to power management, leading to increased investments in power quality equipment. The power quality-equipment market is benefiting from this trend as organizations recognize that poor power quality can lead to equipment damage, increased energy costs, and operational inefficiencies. Surveys indicate that nearly 70% of UK businesses are now prioritizing power quality in their operational strategies. This shift in mindset is likely to propel the demand for power quality solutions, as companies seek to enhance their resilience against power-related challenges.

Increased Investment in Infrastructure Development

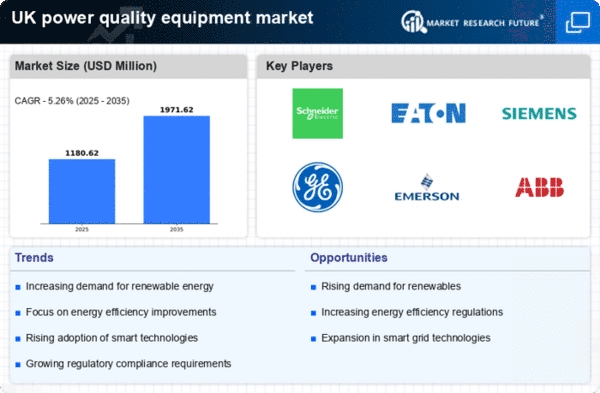

The UK is witnessing a surge in infrastructure development projects, which is positively impacting the power quality-equipment market. As new facilities are constructed and existing ones are upgraded, there is a corresponding need for reliable power quality solutions to support these developments. The government has allocated substantial funding for infrastructure improvements, with an estimated £100 billion earmarked for various projects over the next decade. This investment is likely to create significant opportunities for power quality equipment manufacturers, as the demand for efficient and reliable power systems becomes paramount in new constructions. Consequently, the power quality-equipment market is poised for growth as infrastructure projects continue to expand.

Technological Advancements in Power Quality Solutions

Innovations in power quality equipment are transforming the landscape of the power quality-equipment market. The introduction of smart technologies, such as advanced power monitoring systems and automated voltage regulators, enhances the ability to detect and rectify power quality issues in real-time. These advancements not only improve system reliability but also reduce operational costs for businesses. For instance, the integration of IoT in power quality solutions allows for predictive maintenance, which can decrease downtime by up to 30%. As technology continues to evolve, the power quality-equipment market is likely to see increased adoption of these sophisticated solutions, further driving market growth.

Regulatory Initiatives Promoting Power Quality Standards

Regulatory initiatives in the UK are increasingly focusing on establishing standards for power quality, which is influencing the power quality-equipment market. The government has introduced various guidelines aimed at improving energy efficiency and reducing carbon emissions, which indirectly promotes the adoption of power quality solutions. Compliance with these regulations often necessitates the implementation of advanced power quality equipment to meet specified standards. As a result, businesses are compelled to invest in these technologies to ensure compliance and avoid potential penalties. This regulatory landscape is expected to drive growth in the power quality-equipment market as organizations strive to align with evolving standards.