Rising Industrial Automation

The increasing trend of industrial automation in the US is driving the power quality-equipment market. As industries adopt advanced technologies such as robotics and IoT, the demand for reliable power quality solutions intensifies. Automation systems require stable voltage and minimal disruptions to ensure operational efficiency. According to recent data, the manufacturing sector is projected to grow by approximately 3.5% annually, further necessitating robust power quality equipment. This growth indicates a potential increase in investments in power quality solutions to mitigate risks associated with power disturbances. Consequently, the power quality-equipment market is likely to experience heightened demand as industries seek to enhance productivity and reduce downtime.

Growing Data Center Infrastructure

The expansion of data centers across the US is significantly impacting the power quality-equipment market. With the surge in data consumption and cloud computing, data centers require uninterrupted power supply and high-quality power to maintain operations. The US data center market is expected to reach $100 billion by 2026, indicating a substantial investment in power quality solutions. These facilities are particularly sensitive to power fluctuations, which can lead to data loss and operational inefficiencies. As a result, the demand for power quality equipment, such as UPS systems and power conditioners, is likely to increase, ensuring that data centers operate smoothly and efficiently.

Regulatory Compliance and Standards

The power quality-equipment market is influenced by stringent regulatory compliance and standards set by government agencies in the US. These regulations aim to ensure that electrical systems operate within specified quality parameters, thereby protecting equipment and enhancing safety. For instance, the National Electrical Code (NEC) and various environmental regulations necessitate the use of power quality solutions to meet compliance. Companies that fail to adhere to these standards may face penalties and operational disruptions. As a result, the market for power quality equipment is expected to grow as businesses invest in solutions that help them comply with these regulations, thereby safeguarding their operations and reputation.

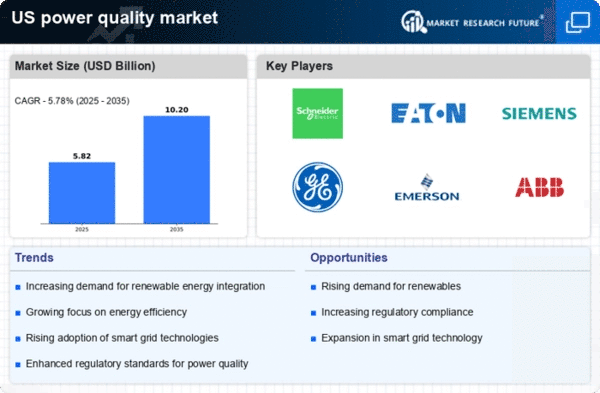

Increased Focus on Renewable Energy Integration

The transition towards renewable energy sources in the US is a key driver for the power quality-equipment market. As more solar and wind energy systems are integrated into the grid, the need for power quality solutions becomes critical. These renewable sources can introduce variability and instability in power supply, necessitating advanced equipment to manage these fluctuations. The US government has set ambitious targets for renewable energy adoption, aiming for 50% of electricity generation from renewables by 2030. This shift is likely to create a substantial demand for power quality equipment that can ensure grid stability and reliability, thereby fostering growth in the market.

Technological Advancements in Power Quality Solutions

Technological advancements in power quality solutions are propelling the market forward. Innovations such as smart inverters, advanced monitoring systems, and energy storage technologies are enhancing the capabilities of power quality equipment. These advancements allow for real-time monitoring and management of power quality issues, which is crucial for industries that rely on sensitive electronic equipment. The market is witnessing a shift towards more sophisticated solutions that can provide predictive analytics and automated responses to power quality disturbances. As industries increasingly adopt these technologies, the power quality-equipment market is expected to expand, driven by the need for enhanced reliability and efficiency.