Advancements in Software Capabilities

Technological advancements are significantly influencing the technical illustration-software market. Innovations in software capabilities, such as enhanced 3D modeling, automation features, and integration with other design tools, are reshaping how technical illustrations are created. These advancements allow users to produce more sophisticated and accurate illustrations with greater efficiency. For instance, the introduction of AI-driven features enables automatic generation of illustrations based on input data, streamlining the workflow for designers. As a result, companies are increasingly adopting these advanced solutions to stay competitive. The technical illustration-software market is likely to see a surge in adoption rates as businesses recognize the value of investing in cutting-edge tools that enhance productivity and creativity in their illustration processes.

Rising Demand for Visual Communication

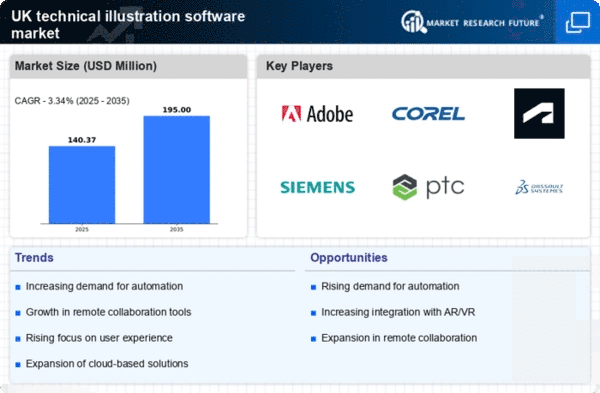

The technical illustration-software market is experiencing a notable increase in demand for visual communication tools. As industries such as engineering, manufacturing, and education seek to enhance their communication strategies, the need for high-quality illustrations becomes paramount. This trend is particularly evident in sectors where complex information must be conveyed clearly and effectively. According to recent data, the market for technical illustration software in the UK is projected to grow at a CAGR of approximately 8% over the next five years. This growth is driven by the necessity for businesses to present intricate concepts visually, thereby improving understanding and collaboration among stakeholders. As a result, software solutions that facilitate the creation of detailed and accurate illustrations are becoming increasingly sought after, indicating a robust future for the technical illustration-software market.

Increased Focus on Training and Education

The technical illustration-software market is benefiting from an increased focus on training and education within various industries. As organizations recognize the value of effective visual communication, they are investing in training programs that equip employees with the skills to utilize technical illustration software proficiently. This trend is particularly pronounced in sectors such as engineering and manufacturing, where accurate illustrations are essential for operational success. Educational institutions are also incorporating technical illustration software into their curricula, preparing the next generation of professionals. Consequently, the demand for user-friendly and educationally supported software solutions is likely to rise, further propelling the growth of the technical illustration-software market.

Growing Importance of Compliance and Standards

In the technical illustration-software market, the growing importance of compliance with industry standards is becoming a critical driver. Many sectors, including aerospace, automotive, and pharmaceuticals, require adherence to strict regulatory guidelines for documentation and illustration. This necessity compels companies to invest in software that not only meets these standards but also simplifies the process of creating compliant illustrations. The technical illustration-software market is thus witnessing an uptick in demand for solutions that offer built-in compliance features, ensuring that illustrations are accurate and meet regulatory requirements. As industries continue to evolve, the emphasis on compliance is expected to drive further growth in the market, as businesses seek to mitigate risks associated with non-compliance.

Expansion of Remote Work and Collaboration Tools

The shift towards remote work is significantly impacting the technical illustration-software market. As teams become increasingly distributed, the need for collaboration tools that facilitate remote work is paramount. Software solutions that enable real-time collaboration on technical illustrations are gaining traction, allowing teams to work together seamlessly, regardless of location. This trend is particularly relevant in industries where project teams must collaborate on complex designs and illustrations. The technical illustration-software market is likely to see a rise in demand for cloud-based solutions that support remote collaboration, as businesses seek to enhance productivity and maintain effective communication among team members. This shift could lead to a transformation in how technical illustrations are created and shared.