Regulatory Compliance and Standards

Regulatory compliance is becoming a significant driver in the technical illustration-software market. Industries such as pharmaceuticals, aerospace, and automotive are subject to stringent regulations that require precise documentation and illustration of processes and products. As companies strive to meet these compliance standards, the demand for specialized illustration software that can produce accurate and detailed representations is increasing. This necessity not only ensures adherence to regulations but also enhances product safety and quality. Consequently, the market is likely to see a steady growth trajectory as organizations prioritize compliance in their operational strategies..

Advancements in Software Capabilities

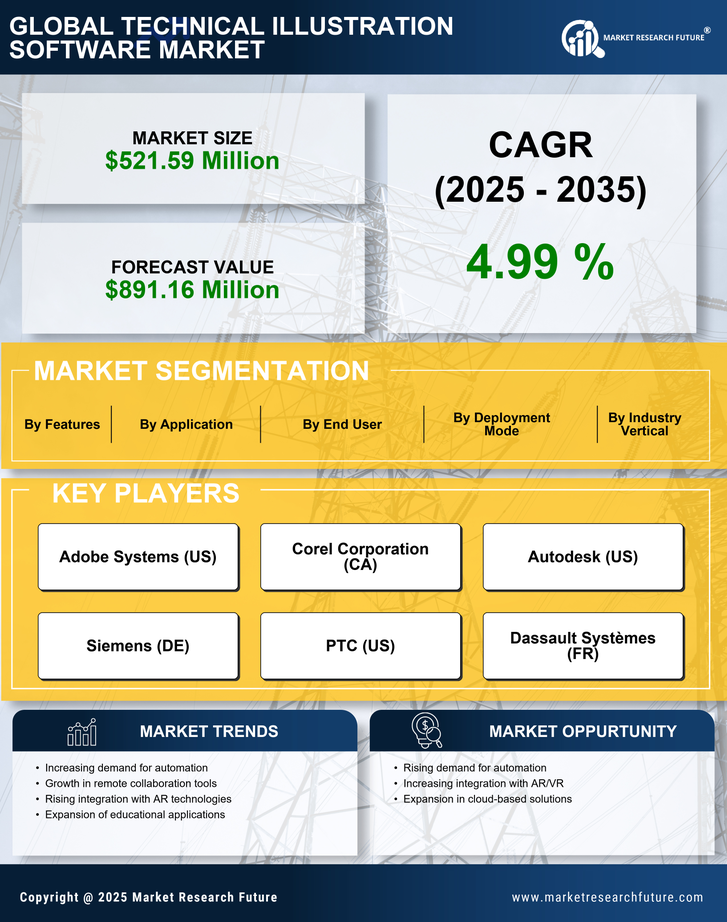

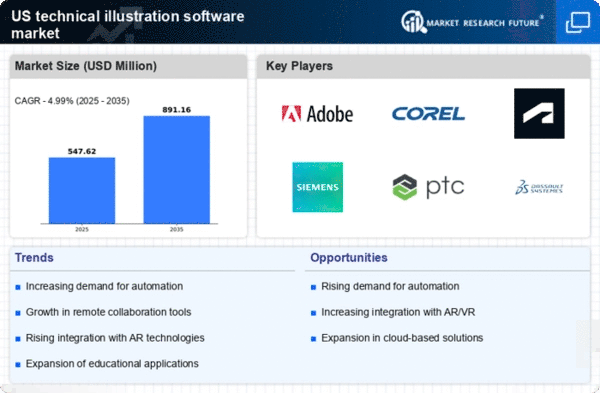

Technological advancements are significantly influencing the technical illustration-software market. The introduction of sophisticated features such as 3D modeling, animation, and interactive elements is transforming how technical illustrations are created and utilized. These advancements enable users to produce more dynamic and engaging content, which is particularly valuable in sectors like education and product design. Furthermore, the integration of artificial intelligence and machine learning into illustration software is streamlining workflows and enhancing user experience. As a result, the market is projected to reach a valuation of over $1 billion by 2026, reflecting the growing reliance on advanced software capabilities in technical illustration.

Rising Demand for Visual Communication

the market is experiencing a notable increase in demand for visual communication tools.. As industries such as manufacturing, engineering, and healthcare continue to evolve, the need for clear and precise illustrations becomes paramount. This demand is driven by the necessity for effective communication of complex ideas and processes. In fact, studies indicate that visual information is processed 60,000 times faster than text, underscoring the importance of technical illustrations. Companies are increasingly investing in software that enhances their ability to convey information visually, leading to a projected growth rate of approximately 8% annually in the technical illustration-software market. This trend highlights the critical role that visual communication plays in modern business practices.

Increased Adoption of E-Learning Platforms

The rise of e-learning platforms is driving growth in the technical illustration-software market. As educational institutions and corporate training programs increasingly adopt digital learning solutions, the demand for high-quality technical illustrations has surged. Illustrations play a crucial role in enhancing comprehension and retention of complex subjects, making them indispensable in online courses. Reports suggest that the e-learning market is expected to grow at a CAGR of 10% through 2027, which in turn fuels the need for effective technical illustration tools. This trend indicates a robust opportunity for software developers to cater to the educational sector, thereby expanding their market reach.

Growing Importance of User Experience Design

User experience (UX) design is increasingly recognized as a critical factor in the technical illustration-software market. As businesses aim to improve customer engagement and satisfaction, the demand for intuitive and user-friendly software solutions is on the rise. Companies are investing in tools that not only facilitate the creation of technical illustrations but also enhance the overall user experience. This focus on UX design is likely to drive innovation within the market, leading to the development of more accessible and efficient software. As a result, the technical illustration-software market is expected to expand, with a projected growth rate of around 7% annually, reflecting the importance of user-centric design in software development.