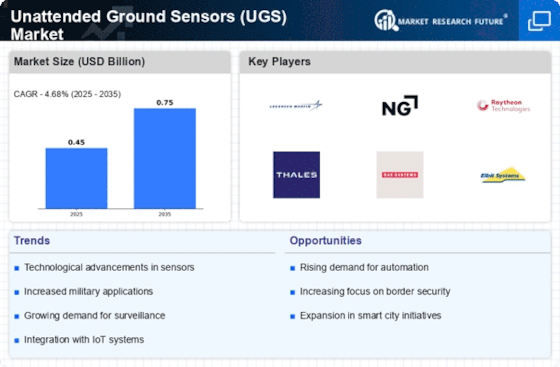

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the unattended ground sensors (UGS) market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, unattended ground sensors (UGS) industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the unattended ground sensors (UGS) industry to benefit clients and increase the market sector. In recent years, the unattended ground sensors (UGS) industry has offered some of the most significant advantages to market.

Major players in the unattended ground sensors (UGS) market attempting to increase market demand by investing in research and development operations include House Tactical Communications (USA), Applied Research Associates Inc. (USA), Elbit Systems Ltd (Israel), Leonardo SpA (Italy), L3Harris Technologies Inc. (the USA), Lockheed Martin Corporation (USA), Textron Inc. (USA), Raytheon Company (USA), Northrop Grumman Corporation (USA) and Thales Group (France).

The aerospace and defence industries are served by Raytheon Technologies Corp.'s technological goods and services. The product line of the corporation includes power generating management and distribution systems, and commercial, flying systems, general aviation and military aircraft engines. Additionally, it provides solutions for cybersecurity, hypersonic, missile defence, electronic warfare, naval warfare, ground warfare, and space. It also provides command and control and communications and navigation services. In addition to aftermarket maintenance, repair, and overhaul (MRO) services, the company offers fleet management services.

In June the Multi-Mission Modular Sensor (MMS), a novel UGS system from Raytheon Technologies, has gone live.

The MMS is a modular system that may be set up to perform a number of different missions, including the detection and tracking of persons, vehicles, and other things.

security and cutting-edge technological systems are provided by Leonardo SpA for use in the aerospace, defence, and security industries. The business creates, develops, produces, and delivers aerostructures, defence electronics, and helicopters. As part of its efforts to deliver space-related services such earth observation, space exploration, satellite navigation, and communication, it also develops BepiColombo, COSMO SkyMed, LISA Pathfinder, PRISMA, MTG, Rosetta, ExoMars, EarthCare, attitude sensors, and atomic clocks. Radar, aeroplane, missile, and undersea systems are among the products offered by Leonardo, along with cyber security solutions, ground vehicles, and land and sea weapon systems.