Unified Threat Management Size

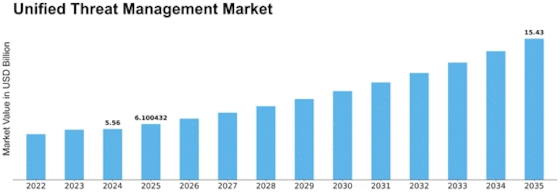

Unified Threat Management Market Growth Projections and Opportunities

Different market dynamics shape the Unified Threat Management (UTM) market. One of these factors is the increasing complexity of digital threats. Another major market factor is the rise in remote working and the adoption of cloud-based services. Organizations are reviewing their network security approaches considering the global shift towards remote and distributed workforces. Due to this, UTM solutions are an attractive option for companies looking to secure their businesses across multiple locations and cloud environments because they provide a centralized view of security. The modern business environment requires flexible and scalable UTM solutions. The regulatory landscape also plays a critical role in driving the UTM market. Severe data protection and cyber security laws are being implemented by states and regulatory bodies globally. Furthermore, mounting awareness about cyber risks among organizations and individuals has fueled growth within the UTM industry as well. Such high-profile hacking occurrences or data breaches have demonstrated that one-size-fits-all mindsets will not suffice when it comes to cybersecurity. To increase efficiency, organizations have realized the potential benefits that come with implementing UTM, which consolidates multiple security features into one platform, thereby enhancing overall safety posture. There is increased awareness among customers about all these matters, which encourages them to adopt these systems across several verticals. The UTM landscape is also influenced by competition in the marketplace coupled with technological advancements. It is characterized by many vendors offering various types of UTM solutions; hence, there's no single vendor that dominates this space outright. Intensive competition promotes development, leading to more advanced capabilities and functionalities for UTM tools. However, price is one of the most significant contributors to growth for UTM products today. The high cost associated with procuring individual security solutions for various threat vectors may discourage some small- and medium-sized entities (SMEs) from investing in such products. Instead, SMEs desiring cost-effective online protection may find themselves considering UTM as an option because it does not require them to break the bank.

Leave a Comment