Market Share

Ureteral Stents Market Share Analysis

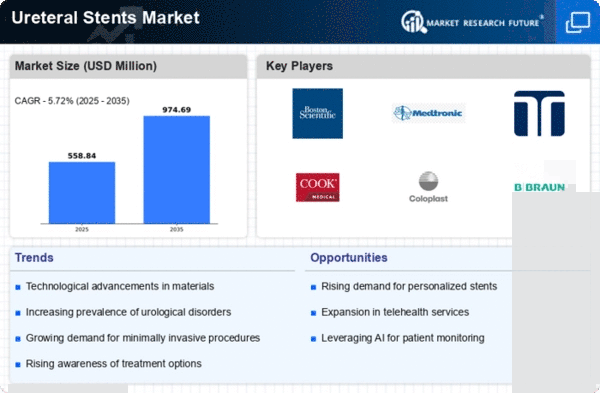

As a result of increasing prevalence rates of urinary tract disorders, companies are making tactical moves towards achieving competitive advantage over others in Ureteral Stents market. In this dynamic environment different positioning strategies for market shares are employed so as to address multiple needs from health care practitioners and patients alike.

Innovation and diversification of a product is one strategic move. With regard to specific clinical situations, firms are putting their money in a range of ureteral stents with different designs and materials. This allows them to adapt to patients’ diverse requirements such as kidney stone problems or post-surgery issues thus ensuring that they have various products that can serve the majority of the customers.

An important role played by pricing strategies is acquisition of market share. As far as possible, all companies competing in the business space should make sure that their Ureteral stents are affordable. Making sure that affordability is balanced with good quality is vital for accessing many providers and institutions involved in healthcare provision including those which operate under stringent budgetary allocations thereby enhancing market penetration.

Capitalizing on the increasing prevalence rates of urological conditions globally has led to global market expansion being adopted as a strategy by most organizations. Through partnerships, regulatory approvals, and adaptation to local needs; the corporations are focusing on entering into new regions across the globe. The result is an expanded clientele base and positioning of these firms among major players in the global urology and urological devices industry.

Research and development forms a foundation upon which profitability is anchored within Ureteral Stents Market. These companies allocate capital towards improving both designs, biocompatibility, durability etc., hence innovate through their stents all together; in order stay ahead hence, be able to keep up with technological changes associated with urological care thus further cementing itself into the market.

Leave a Comment