Market Trends

Key Emerging Trends in the Ureteral Stents Market

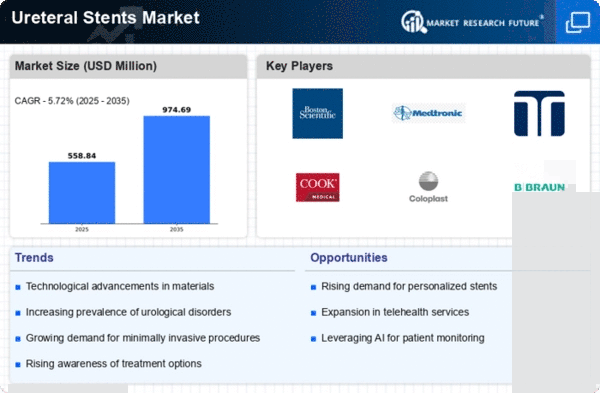

Notably, the Ureteral Stents market has been witnessing trends indicating changing landscapes of urological care. In recent history, there have significant advancements and changes that have accompanied; therefore, ureteral stents which are vital medical equipment used for relieving urinary secretion track obstruction have seen tremendous modifications. For instance, one major trend prevailing in this market is the rising popularity of minimally invasive procedures especially using ureteral stents during endoscopic or laparoscopic surgeries while undertaking operations. Less invasive procedure is presently being preferred due to the increased emphasis on patients comfort ability reduced recovery time frames as well as minimized post-operative examination outcome.

One notable aspect about this market segment is that there has been an increase in the prevalence rate of urological disorders and conditions thus contributing towards more demand for ureteral stents. Several reasons account for why there would be a high number of people requiring such interventions including: increasing number aging population; various lifestyle related matters; and rise of kidney stones (urinary tract stones). From kidney stone cases all through to urethral stricture situations, this demographic transition underscores how important it is to make use of urinary pathway catheters.

The adoption of advanced imaging technologies in urological procedures is on the rise, thereby influencing demand for ureteral stents. This means that healthcare providers can use these technologies such as fluoroscopy and ultrasound to place a stent accurately. Furthermore, using imaging guidance increases the accuracy of procedures which reduces complications and ensures optimal stent placement.

Over the past few years, there has been an increasing attentiveness towards patient centric approaches within healthcare industry with respect to Ureteral Stents market. Hence, health care providers and manufacturers are putting more efforts towards developing stents that will guarantee both comfort and quality life to the patients during their time of need like when they undergo stent placements. This encompasses issues such as coatings for minimal discomfort; proactive steps in removing stents; and counseling patients both during and after stenting.

Manufacturers have increased their product portfolios due to competition in the market. The introduction of different sizes, materials and configurations by companies helps in meeting various needs among medical professionals and clients. Therefore, this diversity creates an opportunity for personalized urological care when features such as patient anatomy and urinary tract condition are considered.

Leave a Comment