Integration of AI and Machine Learning

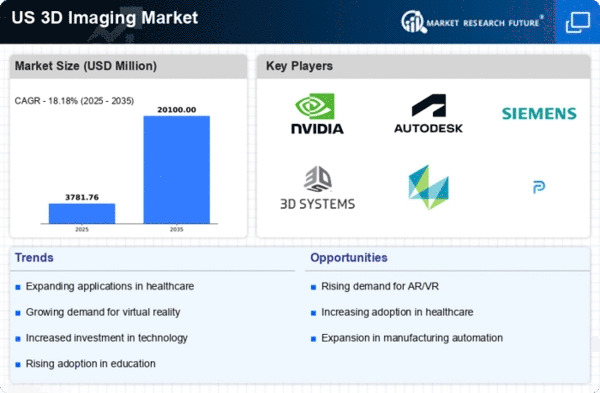

The integration of artificial intelligence (AI) and machine learning into 3D imaging technologies is poised to transform the 3d imaging market. These technologies enable enhanced image processing, automated modeling, and improved data analysis, which can significantly streamline workflows across various industries. As of 2025, the market for AI-driven 3D imaging solutions is anticipated to grow by approximately 18%, reflecting the increasing reliance on intelligent systems for efficiency and accuracy. This trend suggests that the 3d imaging market will continue to evolve, as companies seek to leverage AI capabilities to enhance their imaging processes and deliver superior products.

Advancements in 3D Scanning Technologies

Recent advancements in 3D scanning technologies are significantly influencing the 3d imaging market. Innovations such as high-resolution laser scanning and portable 3D scanners are making it easier for industries like architecture, manufacturing, and construction to adopt 3D imaging solutions. The ability to capture precise measurements and create detailed 3D models is enhancing project efficiency and accuracy. As of 2025, the market for 3D scanning is expected to grow by approximately 20%, driven by the increasing need for accurate data in design and production processes. This trend indicates a robust future for the 3d imaging market, as more sectors recognize the value of integrating advanced scanning technologies into their workflows.

Growing Demand in Entertainment and Media

The 3d imaging market is experiencing a notable surge in demand within the entertainment and media sectors. This growth is primarily driven by the increasing use of 3D technologies in film production, gaming, and virtual reality experiences. As of 2025, the market for 3D content creation is projected to reach approximately $10 billion, reflecting a compound annual growth rate (CAGR) of around 15% over the next five years. The integration of 3D imaging technologies enhances visual storytelling, providing audiences with immersive experiences that traditional 2D formats cannot offer. Consequently, this trend is likely to propel investments in 3D imaging solutions, thereby fostering innovation and competition within the 3d imaging market.

Rising Applications in Education and Training

The application of 3D imaging technologies in education and training is becoming increasingly prevalent, thereby impacting the 3d imaging market. Educational institutions are leveraging 3D models and simulations to enhance learning experiences, particularly in fields such as engineering, medicine, and art. By 2025, the market for educational 3D content is projected to reach $5 billion, with a CAGR of around 12%. This growth is attributed to the effectiveness of 3D visualizations in improving comprehension and retention of complex concepts. As educational institutions continue to adopt these technologies, the 3d imaging market is likely to see a sustained increase in demand for innovative educational tools and resources.

Increased Investment in Research and Development

Investment in research and development (R&D) within the 3d imaging market is on the rise, driven by the need for continuous innovation and improvement. Companies are allocating substantial resources to develop new technologies and applications that can enhance the capabilities of 3D imaging solutions. As of 2025, R&D spending in this sector is expected to exceed $2 billion, reflecting a commitment to advancing imaging technologies. This focus on innovation is likely to yield new products and services that meet the evolving demands of various industries, thereby strengthening the overall position of the 3d imaging market in the technology landscape.

.png)