Growth of E-commerce and Online Retail

The expansion of e-commerce and online retail platforms is significantly impacting the 4k camera market. As consumers increasingly prefer to shop online, the accessibility of 4k cameras has improved, leading to higher sales volumes. In 2025, online sales are expected to represent nearly 40% of total camera sales in the US. This shift is further supported by targeted marketing strategies and the availability of detailed product information online, which helps consumers make informed purchasing decisions. Consequently, the 4k camera market is poised for growth as e-commerce continues to reshape consumer buying habits.

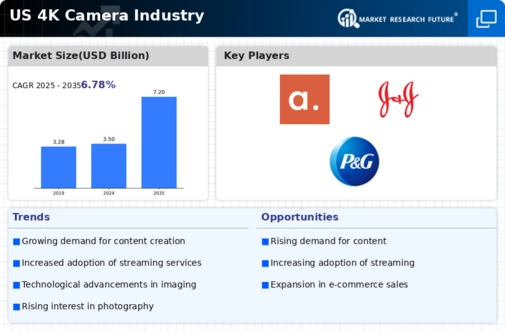

Rising Demand for High-Resolution Content

The increasing consumer preference for high-resolution content is a pivotal driver in the 4k camera market. As streaming services and social media platforms proliferate, the demand for visually stunning content has surged. In 2025, it is estimated that over 70% of online content will be in 4k resolution, compelling content creators to invest in 4k cameras. This trend is further fueled by advancements in display technology, with more consumers acquiring 4k televisions and monitors. Consequently, the 4k camera market is witnessing a robust growth trajectory, as creators seek to produce content that meets the expectations of an increasingly discerning audience.

Increased Adoption in Professional Settings

The 4k camera market is experiencing significant growth due to its increased adoption in professional settings such as filmmaking, broadcasting, and event production. Professionals are increasingly recognizing the value of high-definition video quality, which enhances the overall production value. In 2025, the professional segment is projected to account for approximately 60% of the total market share. This shift is driven by the need for high-quality content in competitive industries, where visual appeal can significantly impact audience engagement. As a result, the 4k camera market is likely to see a surge in demand from professionals seeking to elevate their work through superior imaging technology.

Technological Innovations in Camera Features

Technological innovations are a key driver in the 4k camera market, as manufacturers continuously enhance camera features to attract consumers. Features such as improved low-light performance, advanced autofocus systems, and enhanced stabilization technologies are becoming standard in new models. In 2025, it is anticipated that over 50% of new 4k camera models will incorporate AI-driven functionalities, which could revolutionize the user experience. These advancements not only appeal to amateur photographers but also to professionals who require reliable equipment for demanding shooting conditions. Thus, the 4k camera market is likely to benefit from ongoing technological enhancements that cater to a diverse range of users.

Emerging Trends in Live Streaming and Vlogging

The rise of live streaming and vlogging has emerged as a significant driver for the 4k camera market. As more individuals and brands engage in real-time content creation, the demand for high-quality video equipment has escalated. In 2025, it is estimated that the live streaming segment will account for approximately 30% of the overall market. This trend is particularly prevalent among influencers and content creators who seek to deliver professional-grade visuals to their audiences. As a result, the 4k camera market is likely to experience sustained growth, driven by the increasing popularity of live content across various platforms.

Leave a Comment