Rising Adventure Tourism

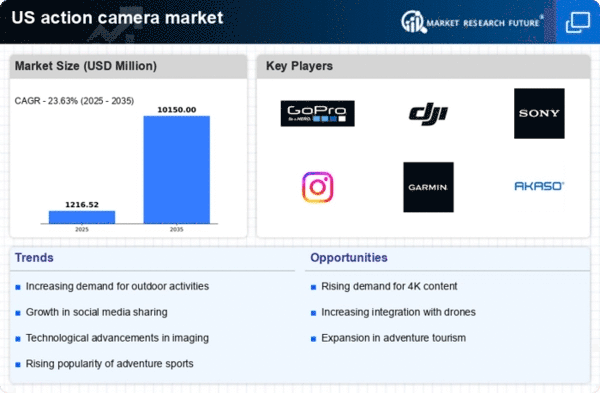

The action camera market experiences a notable boost due to the increasing popularity of adventure tourism in the US. As more individuals engage in activities such as hiking, skiing, and mountain biking, the demand for action cameras rises. In 2025, the adventure tourism sector is projected to grow by approximately 20%, indicating a strong correlation with the action camera market. Consumers seek to capture their experiences in high-definition, driving manufacturers to innovate and enhance camera features. This trend suggests that the action camera market will continue to thrive as adventure tourism becomes more mainstream, with consumers prioritizing quality and durability in their purchases.

Influence of Content Creation

The action camera market benefits significantly from the rise of content creation, particularly among influencers and amateur filmmakers. In 2025, it is estimated that over 50% of US consumers engage in some form of content creation, whether for social media or personal projects. This trend drives demand for high-quality action cameras that can produce professional-grade footage. As platforms like YouTube and Instagram continue to grow, the need for versatile and user-friendly cameras becomes paramount. The action camera market is likely to see increased sales as more individuals invest in equipment that enhances their storytelling capabilities.

Expansion of E-commerce Platforms

The action camera market is experiencing growth due to the expansion of e-commerce platforms in the US. As online shopping becomes more prevalent, consumers are increasingly purchasing action cameras through digital channels. In 2025, e-commerce sales in the electronics sector are projected to rise by 25%, indicating a shift in consumer purchasing behavior. This trend suggests that the action camera market must adapt to the digital landscape, enhancing online visibility and customer engagement. Manufacturers and retailers that leverage e-commerce effectively may see significant increases in sales and market share.

Technological Integration with Smart Devices

The integration of action cameras with smart devices is reshaping the action camera market. As consumers increasingly rely on smartphones and tablets for photography and videography, manufacturers are responding by developing cameras that seamlessly connect with these devices. In 2025, it is projected that around 70% of action camera users will utilize mobile applications for editing and sharing content. This trend indicates a shift towards a more interconnected ecosystem, where the action camera market adapts to consumer preferences for convenience and efficiency. Enhanced connectivity features may lead to higher sales and customer satisfaction.

Growing Interest in Fitness and Outdoor Activities

The action camera market is positively impacted by the growing interest in fitness and outdoor activities among US consumers. As health consciousness rises, more individuals are participating in outdoor sports and fitness regimes, creating a demand for action cameras that can withstand rigorous conditions. In 2025, the fitness industry is expected to grow by 15%, which correlates with increased sales in the action camera market. Consumers are looking for durable, lightweight cameras that can capture their active lifestyles, suggesting that manufacturers will need to focus on producing robust products that cater to this demographic.