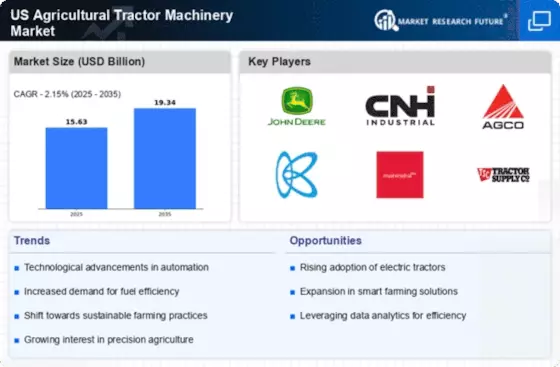

The Agricultural Tractor Machinery Market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and technological advancements. Key players such as Deere & Company (US), CNH Industrial (US), and AGCO Corporation (US) are actively pursuing strategies that emphasize digital transformation and regional expansion. For instance, Deere & Company (US) has been focusing on integrating advanced technologies into its machinery, which not only enhances operational efficiency but also aligns with the growing demand for precision agriculture. Similarly, CNH Industrial (US) is leveraging partnerships to enhance its product offerings, thereby strengthening its market position. Collectively, these strategies contribute to a dynamic competitive environment where companies are not only vying for market share but also striving to lead in innovation and sustainability.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for a diverse range of products and services, catering to various segments of the agricultural sector. However, the collective actions of major companies are likely to shape the market's trajectory, as they seek to capitalize on emerging trends and consumer preferences.

In December 2025, AGCO Corporation (US) announced a strategic partnership with a leading technology firm to develop AI-driven solutions for agricultural machinery. This collaboration is poised to enhance AGCO's product offerings, enabling farmers to leverage data analytics for improved decision-making. The strategic importance of this partnership lies in its potential to position AGCO as a frontrunner in the integration of AI technologies within the agricultural sector, thereby addressing the increasing demand for smart farming solutions.

In November 2025, Kubota Corporation (JP) unveiled its latest line of electric tractors, marking a significant shift towards sustainable farming practices. This launch not only reflects Kubota's commitment to reducing carbon emissions but also aligns with the growing consumer preference for environmentally friendly machinery. The introduction of electric tractors is likely to enhance Kubota's competitive edge, as it caters to a market that is increasingly prioritizing sustainability.

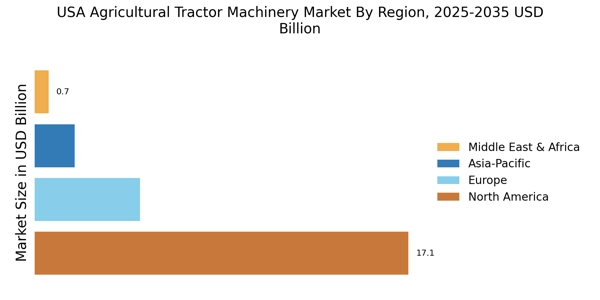

In October 2025, CNH Industrial (US) expanded its manufacturing capabilities in the Midwest, focusing on the production of advanced agricultural equipment. This expansion is strategically significant as it allows CNH to better serve the North American market while optimizing its supply chain. By enhancing local production, CNH Industrial (US) is likely to improve its responsiveness to customer needs and reduce lead times, thereby strengthening its competitive position.

As of January 2026, the Agricultural Tractor Machinery Market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly pivotal in shaping the competitive landscape, as companies collaborate to enhance their technological capabilities. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift suggests that companies that prioritize these aspects are likely to gain a competitive advantage in the rapidly changing market.