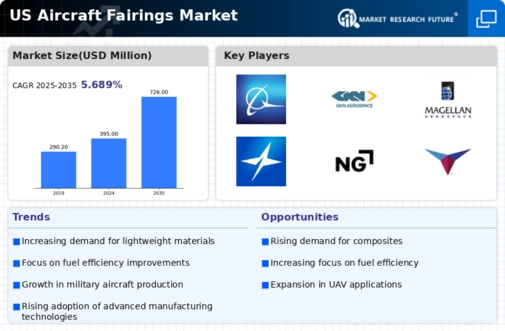

The aircraft fairings market is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and a focus on sustainability. Key players such as Spirit AeroSystems (US), GKN Aerospace (US), and Northrop Grumman (US) are actively pursuing strategies that enhance their market positioning. Spirit AeroSystems (US) has been focusing on expanding its product offerings through technological advancements, while GKN Aerospace (US) emphasizes sustainability in its manufacturing processes. Northrop Grumman (US) appears to be leveraging its defense capabilities to penetrate commercial markets, indicating a multifaceted approach to growth. Collectively, these strategies suggest a dynamic environment where companies are not only competing on product quality but also on their ability to innovate and adapt to changing market demands.

In terms of business tactics, localizing manufacturing and optimizing supply chains have emerged as critical strategies for success. The market structure is moderately fragmented, with several players vying for market share. However, the influence of major companies like Boeing (US) and Raytheon Technologies (US) cannot be understated, as they hold substantial market power and resources. Their ability to streamline operations and enhance production efficiency contributes to shaping the competitive dynamics within the market.

In November 2025, Spirit AeroSystems (US) announced a partnership with a leading aerospace manufacturer to develop next-generation fairings that incorporate advanced composite materials. This strategic move is likely to enhance their product portfolio and position them as a leader in innovation. The collaboration not only signifies a commitment to technological advancement but also aligns with the growing demand for lightweight and fuel-efficient aircraft components.

In October 2025, GKN Aerospace (US) unveiled its new sustainability initiative aimed at reducing carbon emissions in the production of aircraft fairings. This initiative is expected to resonate well with environmentally conscious customers and stakeholders, potentially giving GKN a competitive edge in a market that increasingly values sustainability. By prioritizing eco-friendly practices, GKN Aerospace (US) is likely to attract partnerships and contracts that emphasize corporate responsibility.

In September 2025, Northrop Grumman (US) expanded its manufacturing capabilities by investing in a state-of-the-art facility dedicated to the production of aircraft fairings. This investment not only enhances their operational efficiency but also positions them to meet the growing demand for advanced aerospace components. The establishment of this facility indicates a long-term commitment to the market and a strategic move to bolster their competitive standing.

As of December 2025, the competitive trends within the aircraft fairings market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident. Moving forward, competitive differentiation will likely hinge on the ability to innovate and adapt to emerging trends, suggesting a transformative phase for the market.

Leave a Comment