Growing Demand for Grid Stability

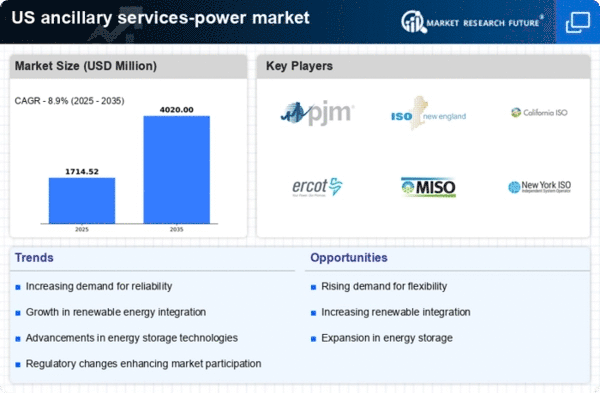

The increasing complexity of the power grid, driven by the integration of diverse energy sources, has led to a heightened demand for services that ensure grid stability. The ancillary services-power market plays a crucial role in maintaining the balance between supply and demand, particularly as renewable energy sources become more prevalent. In 2025, the market for ancillary services is projected to reach approximately $10 billion, reflecting a compound annual growth rate (CAGR) of around 8%. This growth is indicative of the essential nature of ancillary services in supporting grid reliability and resilience, especially during peak demand periods.

Regulatory Support for Energy Transition

Regulatory frameworks are evolving to support the transition towards a more sustainable energy landscape, which directly influences the ancillary services-power market. Policies aimed at reducing carbon emissions and promoting renewable energy adoption are likely to create new opportunities for ancillary services. In 2025, it is anticipated that regulatory incentives will drive a 25% increase in ancillary services demand, as utilities seek to comply with stricter environmental standards. This regulatory support is crucial for fostering innovation and investment in ancillary services, ensuring that the power grid remains reliable and efficient.

Increased Investment in Smart Grid Technologies

Investment in smart grid technologies is transforming the ancillary services-power market by enhancing operational efficiency and reliability. These technologies facilitate real-time monitoring and management of energy resources, which is vital for integrating renewable energy sources. As of 2025, it is estimated that investments in smart grid initiatives will exceed $20 billion in the US, significantly impacting the ancillary services sector. The adoption of advanced metering infrastructure and automated demand response systems is likely to streamline ancillary services, thereby improving overall grid performance and reducing operational costs.

Rising Consumer Participation in Energy Markets

The trend of increasing consumer participation in energy markets is reshaping the ancillary services-power market. With the advent of distributed energy resources (DERs) and demand response programs, consumers are becoming active players in energy management. This shift is expected to enhance the flexibility and responsiveness of the ancillary services market. By 2025, consumer-driven initiatives could account for up to 15% of ancillary services capacity, indicating a significant transformation in how these services are procured and utilized. This evolution may lead to more competitive pricing and innovative service offerings.

Emerging Market for Frequency Regulation Services

The ancillary services-power market is witnessing a burgeoning demand for frequency regulation services, essential for maintaining the stability of the electrical grid. As the penetration of variable renewable energy sources increases, the need for rapid response services to balance supply and demand becomes more critical. By 2025, the market for frequency regulation is projected to grow by 30%, driven by advancements in battery storage technologies and demand response capabilities. This growth underscores the importance of ancillary services in ensuring grid reliability and the overall efficiency of the power system.