Growing Demand for Grid Reliability

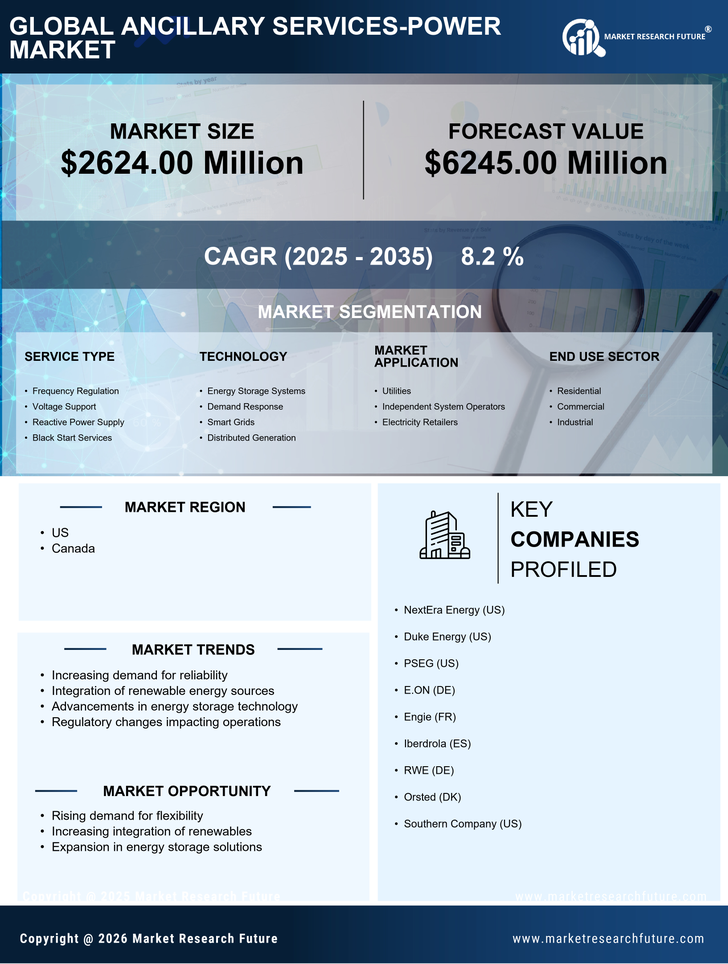

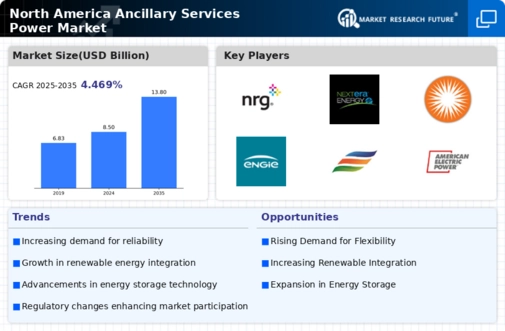

As the energy landscape evolves, the demand for grid reliability has become paramount. The increasing frequency of extreme weather events and the integration of intermittent renewable energy sources have heightened the need for ancillary services. Utilities are now prioritizing investments in services that ensure grid stability and reliability. The ancillary services-power market is responding to this demand by expanding its offerings, which may include frequency regulation and voltage support. According to recent data, the market for ancillary services is projected to grow at a CAGR of 10% through 2030, driven by the necessity for enhanced grid resilience and operational efficiency.

Regulatory Support for Ancillary Services

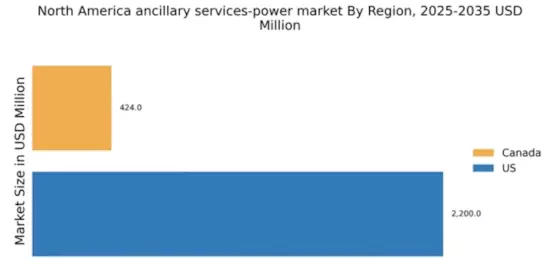

The regulatory framework in North America plays a crucial role in shaping the ancillary services-power market. Recent policies have emphasized the need for reliable grid operations, which has led to increased demand for ancillary services. For instance, the Federal Energy Regulatory Commission (FERC) has implemented measures to enhance market participation, thereby fostering competition among service providers. This regulatory support is expected to drive investments in ancillary services, as utilities and independent system operators seek to comply with evolving standards. The ancillary services-power market is likely to witness a surge in capacity as stakeholders adapt to these regulations, potentially increasing market size by 15% over the next five years.

Technological Innovations in Energy Storage

Technological advancements in energy storage solutions are significantly impacting the ancillary services-power market. Innovations such as lithium-ion batteries and other storage technologies enable better management of energy supply and demand. These advancements facilitate the provision of ancillary services like load balancing and frequency regulation, which are essential for maintaining grid stability. The ancillary services-power market is likely to benefit from the decreasing costs of energy storage systems, which have dropped by approximately 50% over the past five years. This trend suggests that more players may enter the market, enhancing competition and service diversity.

Economic Incentives for Ancillary Service Providers

Economic incentives are becoming increasingly important in the ancillary services-power market. Financial mechanisms such as capacity payments and performance-based incentives encourage service providers to enhance their offerings. These incentives are designed to ensure that ancillary services are available when needed, thereby improving overall grid reliability. The ancillary services-power market is likely to see a rise in participation from various stakeholders, including traditional utilities and new entrants, as these economic drivers create a more attractive business environment. Recent analyses suggest that the market could expand by 12% annually as a result of these incentives, fostering innovation and service diversification.

Increased Participation of Distributed Energy Resources

The rise of distributed energy resources (DERs) is reshaping the ancillary services-power market. With more consumers generating their own electricity through solar panels and other technologies, the need for ancillary services to manage these resources is growing. DERs can provide valuable services such as demand response and local energy balancing, which are crucial for grid management. The ancillary services-power market is adapting to this shift by developing frameworks that allow for the integration of DERs into existing systems. This trend could lead to a 20% increase in ancillary service offerings by 2027, as utilities seek to leverage the potential of these resources.