Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the antibody drug-discovery market. Innovations in genetic engineering, monoclonal antibody production, and high-throughput screening techniques enhance the efficiency and effectiveness of drug discovery processes. The integration of artificial intelligence and machine learning in research is streamlining the identification of potential antibody candidates, thereby reducing time and costs associated with drug development. In the US, the biotechnology sector is projected to reach a market value of $500 billion by 2026, indicating a robust environment for antibody drug development. These advancements not only facilitate the discovery of novel therapeutics but also improve the overall success rates of clinical trials, further propelling the antibody drug-discovery market.

Regulatory Support for Biologics

Regulatory frameworks in the US are evolving to support the development and approval of biologics, including antibody therapies. The Food and Drug Administration (FDA) has implemented initiatives to expedite the review process for innovative biologics, such as the Breakthrough Therapy Designation and Accelerated Approval pathways. These regulatory advancements are designed to facilitate faster access to life-saving treatments for patients with serious conditions. As a result, the antibody drug-discovery market is poised for growth, as companies can bring their products to market more efficiently. The favorable regulatory environment encourages investment and innovation, ultimately benefiting patients who require novel therapeutic options.

Growing Demand for Targeted Therapies

The shift towards personalized medicine and targeted therapies is reshaping the landscape of the antibody drug-discovery market. Patients and healthcare providers increasingly prefer treatments that are tailored to individual genetic profiles and disease characteristics. This trend is evident in the rising approval rates of monoclonal antibodies that specifically target cancer cells or modulate immune responses. In the US, the market for targeted therapies is expected to reach $150 billion by 2025, reflecting a growing preference for precision medicine. Consequently, the antibody drug-discovery market is likely to expand as researchers focus on developing more specific and effective antibody-based treatments that align with this demand.

Rising Prevalence of Chronic Diseases

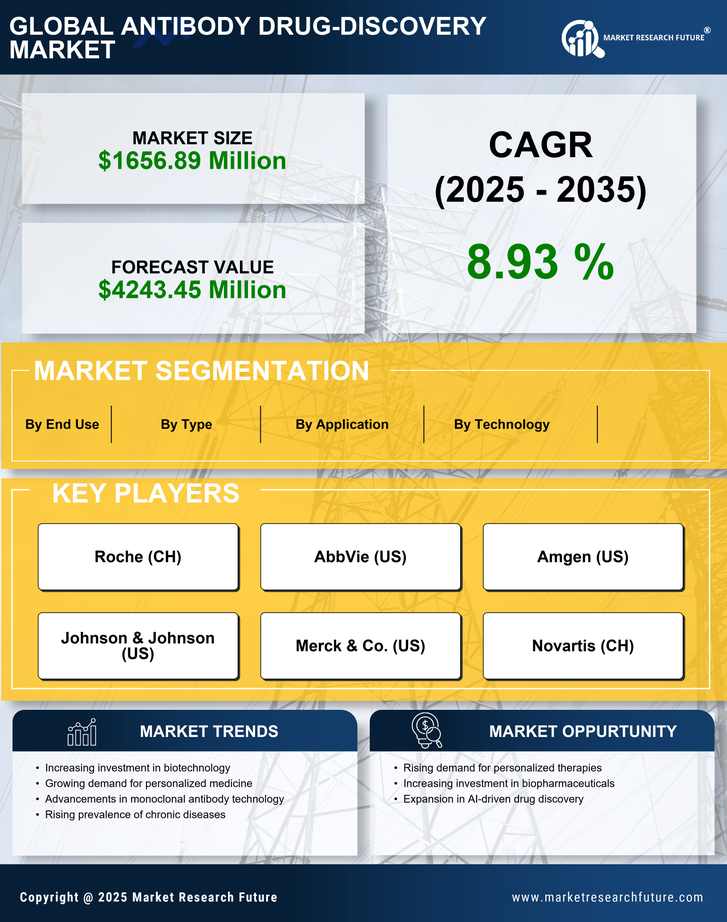

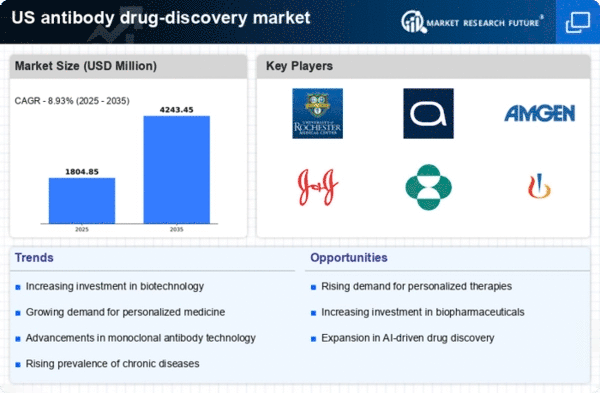

The increasing incidence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases is a primary driver for the antibody drug-discovery market. As the population ages, the demand for innovative therapeutic solutions rises. In the US, chronic diseases account for approximately 70% of all deaths, highlighting the urgent need for effective treatments. This trend propels research and development investments in antibody therapies, as they offer targeted approaches with potentially fewer side effects compared to traditional treatments. The antibody drug-discovery market is expected to witness substantial growth. Projections indicate a compound annual growth rate (CAGR) of around 10% over the next several years, driven by the need for advanced therapies to combat prevalent health issues.

Increased Investment in Research and Development

The antibody drug-discovery market is experiencing a surge in investment from both public and private sectors. Funding for research and development (R&D) initiatives is critical for advancing the discovery of new antibody-based therapies. In the US, federal funding for biomedical research has seen a steady increase, with the National Institutes of Health (NIH) allocating over $40 billion annually for various health-related research projects. This financial support fosters innovation and encourages collaboration between academic institutions and pharmaceutical companies. As a result, the antibody drug-discovery market is likely to benefit from a more robust pipeline of novel therapeutics, addressing unmet medical needs and enhancing patient outcomes.