Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the antibody drug-discovery market in South Korea. Innovations such as CRISPR gene editing, high-throughput screening, and next-generation sequencing are enhancing the efficiency and accuracy of antibody development. These technologies enable researchers to identify and optimize potential therapeutic candidates more rapidly, thereby reducing the time and cost associated with drug development. Furthermore, the South Korean biotech sector is witnessing substantial investments, with the government allocating over $1 billion to support biotech research initiatives. This influx of funding is likely to accelerate the discovery of novel antibodies, thereby expanding the therapeutic options available in the market.

Supportive Government Policies

Supportive government policies play a pivotal role in shaping the antibody drug-discovery market in South Korea. The government has implemented various initiatives aimed at fostering innovation and collaboration within the biotech sector. For instance, the establishment of the Korean Biotech Strategy aims to enhance the competitiveness of the industry by providing funding, tax incentives, and regulatory support for biotech companies. These policies are designed to streamline the drug approval process and encourage public-private partnerships, thereby facilitating the development of new antibody therapies. As a result, the antibody drug-discovery market is likely to benefit from an increasingly favorable regulatory environment, which could lead to accelerated product development and commercialization.

Growing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in South Korea is a critical driver for the antibody drug-discovery market. Conditions such as cancer, diabetes, and cardiovascular diseases are becoming increasingly common, necessitating the development of effective therapeutic solutions. According to recent health statistics, cancer is the leading cause of death in South Korea, with over 200,000 new cases diagnosed annually. The rising prevalence of chronic diseases has prompted healthcare providers and researchers to seek innovative treatments, including monoclonal antibodies, which have shown promise in improving patient outcomes. Consequently, the antibody drug-discovery market is expected to expand as stakeholders respond to the urgent need for effective therapies targeting these chronic conditions.

Increasing Demand for Targeted Therapies

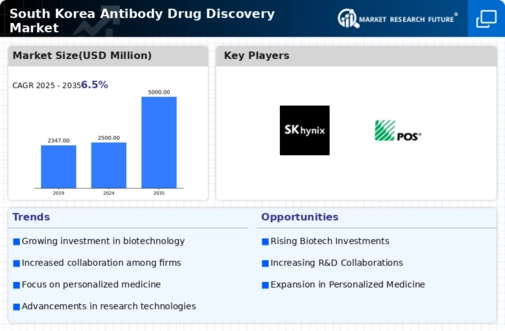

The antibody drug-discovery market in South Korea is experiencing a notable surge in demand for targeted therapies. This trend is driven by the growing recognition of the limitations of traditional therapies, which often lack specificity and can lead to adverse effects. Targeted therapies, particularly those utilizing monoclonal antibodies, are perceived as more effective and safer options for treating various diseases, including cancer and autoimmune disorders. The South Korean government has been promoting R&D in this area, with funding initiatives aimed at fostering innovation. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, reflecting the increasing focus on precision medicine within the antibody drug-discovery market.

Rising Awareness of Personalized Medicine

There is a growing awareness of personalized medicine among healthcare professionals and patients in South Korea, which is significantly impacting the antibody drug-discovery market. Personalized medicine, which tailors treatment based on individual patient characteristics, is gaining traction as a more effective approach to healthcare. This shift is prompting researchers to focus on developing antibodies that can be customized to target specific biomarkers associated with various diseases. The South Korean healthcare system is increasingly adopting this model, with initiatives aimed at integrating personalized treatment options into clinical practice. As a result, the antibody drug-discovery market is expected to expand as more stakeholders recognize the potential benefits of personalized therapies.