Regulatory Compliance and Standards

The automotive connectors market is increasingly shaped by stringent regulatory compliance and industry standards aimed at enhancing vehicle safety and performance. Regulatory bodies are implementing guidelines that require manufacturers to adopt high-quality connectors that meet specific performance criteria. This trend is particularly evident in the US, where regulations are becoming more rigorous in response to growing safety concerns. As a result, manufacturers are compelled to invest in advanced connector technologies that comply with these standards, thereby driving innovation within the automotive connectors market. This focus on compliance not only ensures safety but also enhances the overall reliability of automotive systems.

Increased Electrification of Vehicles

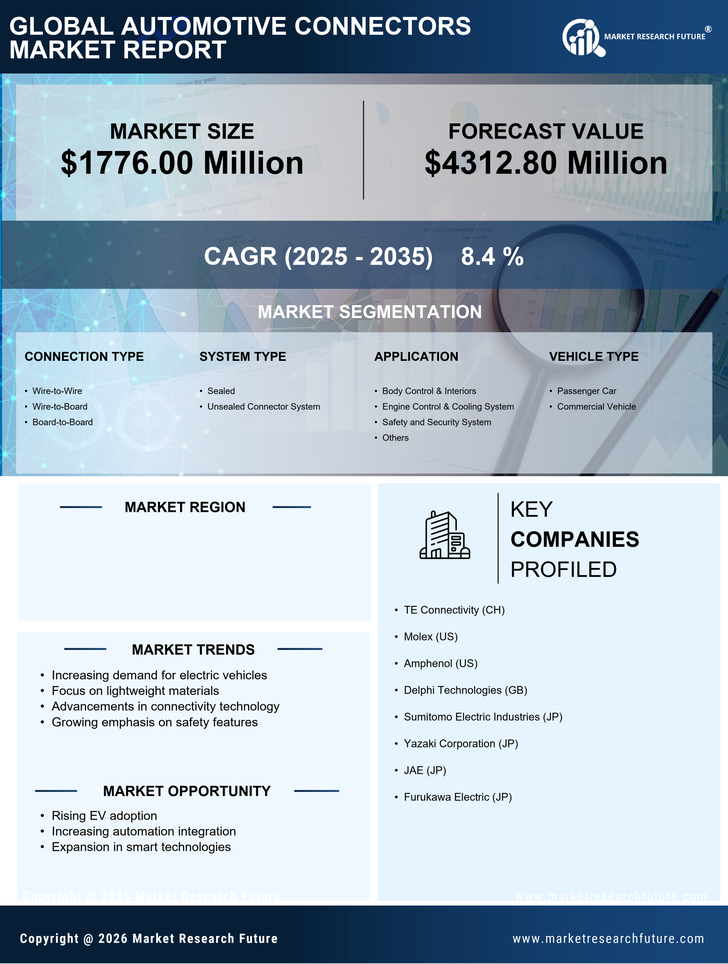

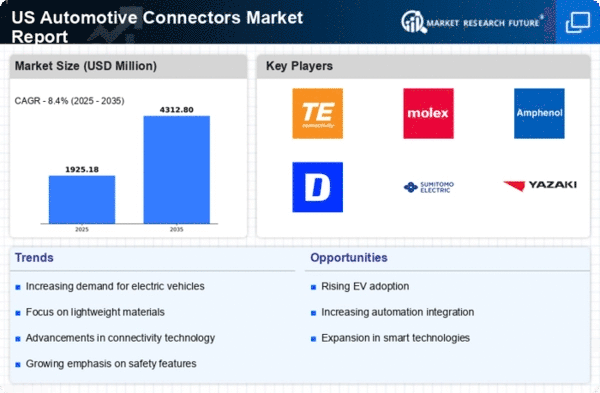

The automotive connectors market is witnessing a shift towards increased electrification of vehicles, particularly with the rise of hybrid and electric vehicles. This transition necessitates specialized connectors that can handle higher voltages and currents, ensuring efficient power distribution and management. The market for electric vehicles in the US is projected to grow at a CAGR of around 20% from 2025 to 2030, indicating a robust demand for connectors that support electric drivetrains. As automakers focus on enhancing battery performance and charging capabilities, the automotive connectors market is likely to evolve, offering innovative solutions that cater to the unique requirements of electrified vehicles.

Growth of Autonomous Vehicle Technology

The automotive connectors market is significantly influenced by the rapid advancements in autonomous vehicle technology. As manufacturers develop self-driving cars, the complexity of electronic systems increases, necessitating a robust network of connectors to facilitate communication between sensors, cameras, and control units. The market for autonomous vehicles is expected to reach $557 billion by 2026, which suggests a substantial opportunity for the automotive connectors market. This growth is likely to drive innovation in connector design and functionality, as manufacturers seek to meet the stringent requirements of autonomous systems, thereby enhancing the overall safety and efficiency of vehicles.

Rising Demand for Advanced Safety Features

The automotive connectors market is experiencing a notable surge in demand for advanced safety features in vehicles. As consumers increasingly prioritize safety, manufacturers are integrating sophisticated technologies such as collision avoidance systems and adaptive cruise control. These systems rely heavily on reliable and efficient connectors to ensure seamless communication between various electronic components. In fact, the market for automotive safety systems is projected to grow at a CAGR of approximately 8% through 2027, driving the need for high-quality connectors. This trend indicates that the automotive connectors market is likely to expand as automakers invest in safety innovations, thereby enhancing the overall vehicle performance and consumer trust.

Expansion of Vehicle Electrification Infrastructure

The automotive connectors market is positively impacted by the expansion of vehicle electrification infrastructure across the US. As charging stations become more prevalent, the demand for connectors that facilitate efficient charging solutions is likely to increase. The US government has committed to investing in electric vehicle infrastructure, with plans to install over 500,000 charging stations by 2030. This initiative suggests a growing market for connectors that support fast charging and high-power applications. Consequently, the automotive connectors market is expected to benefit from this infrastructure development, as manufacturers seek to provide reliable and efficient solutions that meet the evolving needs of electric vehicle users.