Increased Focus on Snackification

The trend of snackification is significantly influencing the baked foods market, as consumers increasingly prefer convenient, on-the-go snack options. This shift appears to be driven by busy lifestyles and a desire for quick, satisfying food choices. The baked foods market is adapting by developing a range of snackable baked goods, such as mini pastries, bite-sized cookies, and savory crackers. In 2025, it is projected that snackable products will account for nearly 35% of the total baked foods market, indicating a substantial shift in consumer preferences. This trend may encourage manufacturers to innovate and diversify their product offerings, catering to the growing demand for convenient and portable snacks.

Growth of E-Commerce and Online Sales

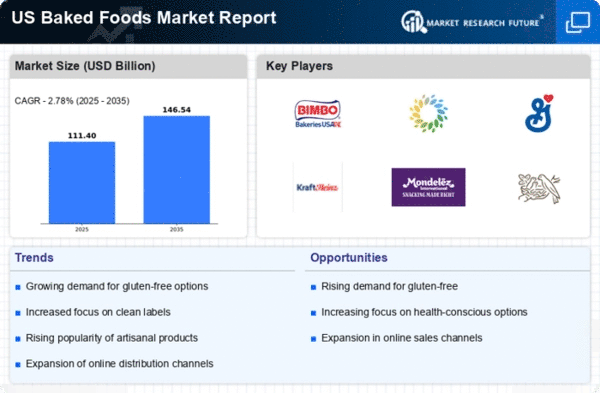

The baked foods market is witnessing a significant transformation due to the rise of e-commerce and online sales channels. As consumers increasingly turn to online platforms for their grocery shopping, the baked foods market is adapting by enhancing its digital presence and distribution strategies. In 2025, online sales of baked goods are expected to grow by approximately 25%, reflecting a shift in consumer purchasing behavior. This trend may encourage traditional brick-and-mortar bakeries to establish online storefronts, thereby expanding their reach and catering to a broader audience. The convenience of online shopping, coupled with the ability to access a wider variety of products, is likely to reshape the competitive landscape of the baked foods market.

Innovations in Flavor and Ingredients

Innovation in flavor profiles and ingredient sourcing is becoming a pivotal driver in the baked foods market. Consumers are increasingly seeking unique and diverse flavors, prompting manufacturers to experiment with exotic ingredients and artisanal techniques. The baked foods market is responding to this demand by introducing products that incorporate superfoods, organic ingredients, and international flavors. In 2025, it is anticipated that the market for specialty baked goods will grow by 15%, as consumers seek out products that offer both taste and health benefits. This trend may lead to collaborations between bakers and chefs, fostering creativity and enhancing the overall consumer experience.

Rising Demand for Gluten-Free Products

The baked foods market is experiencing a notable shift towards gluten-free offerings, driven by an increasing number of consumers adopting gluten-free diets. This trend appears to be influenced by a growing awareness of gluten intolerance and celiac disease, prompting manufacturers to innovate and expand their gluten-free product lines. In 2025, the gluten-free segment is projected to account for approximately 30% of the total baked foods market, reflecting a significant increase from previous years. As consumers prioritize health and dietary restrictions, the baked foods market is likely to see a surge in demand for gluten-free bread, pastries, and snacks, which could lead to enhanced product development and marketing strategies aimed at this demographic.

Sustainability and Eco-Friendly Packaging

Sustainability has emerged as a critical driver in the baked foods market, with consumers increasingly favoring products that utilize eco-friendly packaging and sustainable sourcing practices. The baked foods market is responding to this demand by adopting biodegradable and recyclable materials, which not only appeal to environmentally conscious consumers but also align with broader corporate social responsibility goals. In 2025, it is estimated that around 40% of consumers are willing to pay a premium for sustainably packaged baked goods. This shift towards sustainability may compel manufacturers to rethink their supply chains and production processes, potentially leading to innovations that reduce environmental impact while maintaining product quality.